Release Notes 2025

December 2025

November 2025

October 2025

September 2025

August 2025

July 2025

June 2025

May 2025

April 2025

March 2025

February 2025

January 2025

Frequently Asked Questions!

How do I access field level help?

How do I see descriptions of codes in enquiry screens?

How do I make a user have read only access

Can I copy and delete lines in data entry screens?

Out of Office

Can I run a report to view security groups against my users?

How do I stop a user posting to prior and future periods?

Delete a payment run

Changing security access to a user

User setup requires multiple screens and is complicated!

De-allocate an AP Payment

How to stop over receipting of orders

Why has my transaction not appeared on the AP Payment run?

Download Templates

Useful information to include when raising Financials cases

Prevent users posting to specific balance classes

Hints and Tips!

General Ledger - Helpful how-to guides

General Ledger Data Entry

General Ledger Enquiries

GL Enquiries - Transaction Enquiries

GL Enquiries - Balance Sheet & Profit and Loss

GL Enquiries - Account Details

Trial Balance

Period and Year End Close

General Ledger Security

Accounts Payable - Helpful how-to guides

Accounts Payable Supplier File

Accounts Payable Data Entry

Log and Invoice/Credit note

Enter a logged Invoice

Enter a non order related Invoice

Order Related Invoice

Order Related Invoices with Mismatches

Order Related Invoice - Mismatch Scenarios

Mismatch Types

Invoice and Credit Note Matching

Accounts Payable Enquiries

Accounts Payable Transaction Maintenance

Accounts Payable Payment Processing

Accounts Payable Code Tables

Accounts Payable Reports

Accounts Receivable - Helpful how-to guides

Customer Maintenance

Enquiries

Cash Allocation

Data Entry & Contracts

Student Sponsor - Education sector

Credit Control

Credit Control Overview

Customer Statements

Diary Notes

Query Management

Interest Charges

Dunning Process

Credit Control Diary

Reporting within Financials

Student Sponsor - Education Sector

Purchasing Management - Helpful how-to guides

Fixed Assets - Helpful how-to guides

Prompt File - Asset Creation

Join Prompt File Items

Fixed Assets Period End & Depreciation

Revaluation

Disposals

Relife

Reconciliation process - Helpful how-to guides

Accounts Receivable Reconciliation Reporting

Accounts Payable Reconciliation Reporting

Daily Checks

Fixed Assets Reconciliation Reporting

General Ledger Reconciliation Reporting

Purchasing Management Reconciliation Reporting

Reporting

General Ledger Reports

Accounts Payable Reports

Accounts Receivable Reports

Sales Invoicing Reports

Fixed Assets Reports

Bank Reconciliation Reports

Import Tool Kit

Procurement Portal

Procurement Portal new User Interface

Navigation

Requisitions

Orders

Authorisation

Receiver

Invoice Clearance

Portal Administration

Procurement Portal - Teams Setup

Invoice Manager

Purchase Invoice Automation (PIA)

January 2026 Release notes

Deleting Supplier training data

Password Reset in Smart-Capture

Adding a New User - Smart Workflow

Resetting password - Smart Workflow

Purchase Invoice Automation

New User Interface

BPM

Request a nominal

Request a customer

Request a Sales Invoice

Request a management code

Create a Pay Request

Request a Supplier

Bring Your Own BI (BYOBI)

Collaborative Planning

Financial Reporting Consolidation

Air Approvals

Registering Air Approvals

Air Approvals Administration – Create Mobile User

Air Approvals Administration – Reset User’s Activation Key

Reviewing Approvals

Disable/Enable a User

Delete a User

Release Notes 2024

December 2024

November 2024

October 2024

September 2024

August 2024

July 2024

June 2024 Release

May 2024

April 2024

March 2024

February 2024

January 2024

API

Release Notes - Previous years

Contents

- All categories

- Accounts Receivable - Helpful how-to guides

- Credit Control

- Credit Control Diary

Credit Control Diary

Updated

by Caroline Buckland

Updated

by Caroline Buckland

Credit Control Diary

The credit control diary allows the user to create and maintain diary ‘events’.

Diary events can be used to record some action that needs to be taken in the future, or has taken place.

The diary is held at account level, i.e. a diary event is entered against the whole account and not against individual transactions.

From the diary the user can link to Credit Limit Maintenance, Query Management, Account Details and Aged Debt Analysis.

Access the following menus:

Accounts Receivable>AR Processes>Credit Controls>Maintain Diary notes

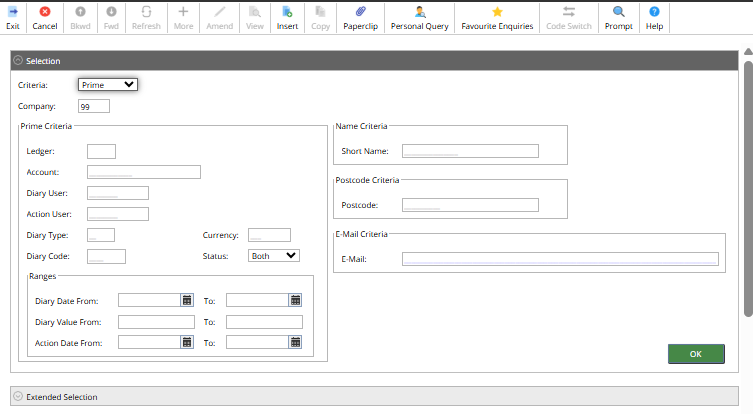

Using The Selection Window

Two types of search criteria are available to the user.

- Prime Search

- Short Name

Prime Search

Where the user can search for a diary event using standard search criteria.

For example, Action Date From and To, Action User, Query/Dispute codes.

Short Name

Used to retrieve a list of diary events for customers with a specific Short Name. The ‘wildcard’ characters may be used.

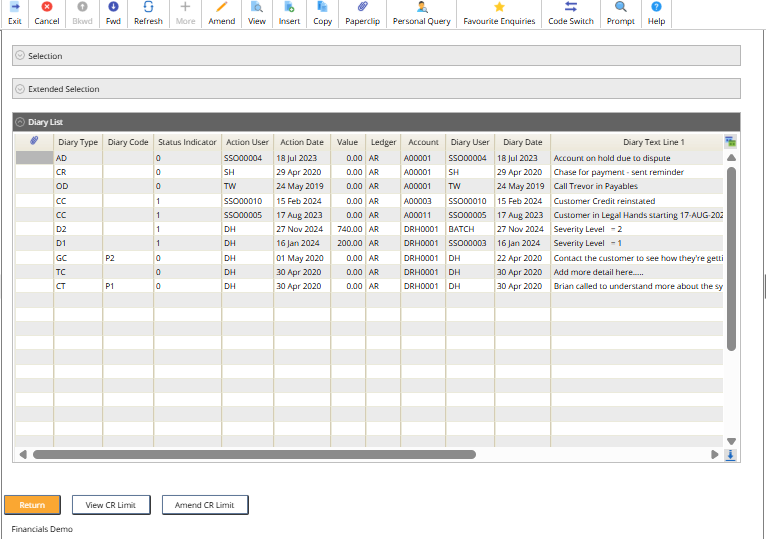

Using the Diary

Selecting OK from the selection window will list the diary events.

When the selection window parameters have been entered, the system will display selected diary events in a summary format for the entered parameters. From here the user can insert a new diary event or view, amend or copy an existing diary event.

A parameter set at Company Controls defines the sequence that retrieved diary events will be displayed, either in date sequence with the oldest event first, or in reverse date sequence with the most recent event first.

Amending Existing Diary Events

The Amend action can be used against a diary event, by selecting the Amend icon, where the details that can be amended are highlighted. These fields are:

- Date

- User

- Type

- Diary Code

- Status (Active to Inactive)

All amendments must be updated to save the new details.

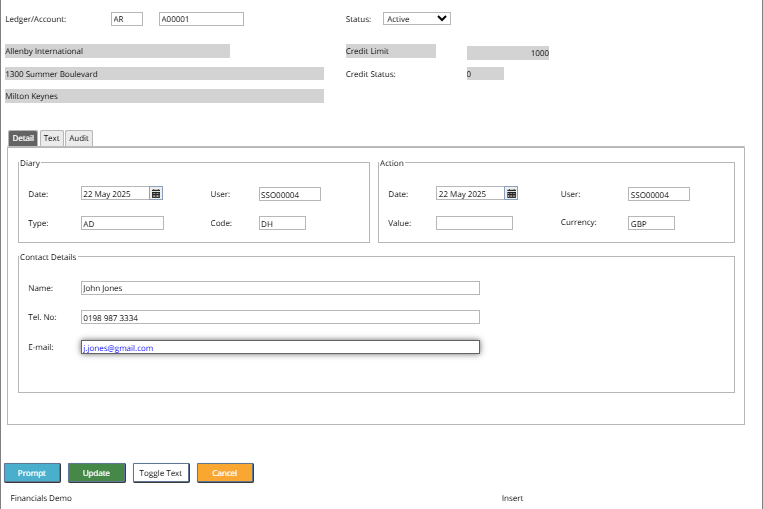

Inserting Diary Events

When inserting new diary events the user can either build a list of customer accounts first and then select the Insert action next to the account, or select the Insert action at the selection window. On the Diary Insert screen the user can enter:

- Ledger and Account

- Diary Type to classify the diary event. E.g. Letter, Site Visit, Telephone Call, Credit Change, etc. Prompt can be used.

- Diary Code to further classify the Diary Event. For example, this code may be used to indicate the priority or originator. This field is optional and Prompt can be used.

- Diary User and Diary Date for the event.

- Action User and Action Date for the event.

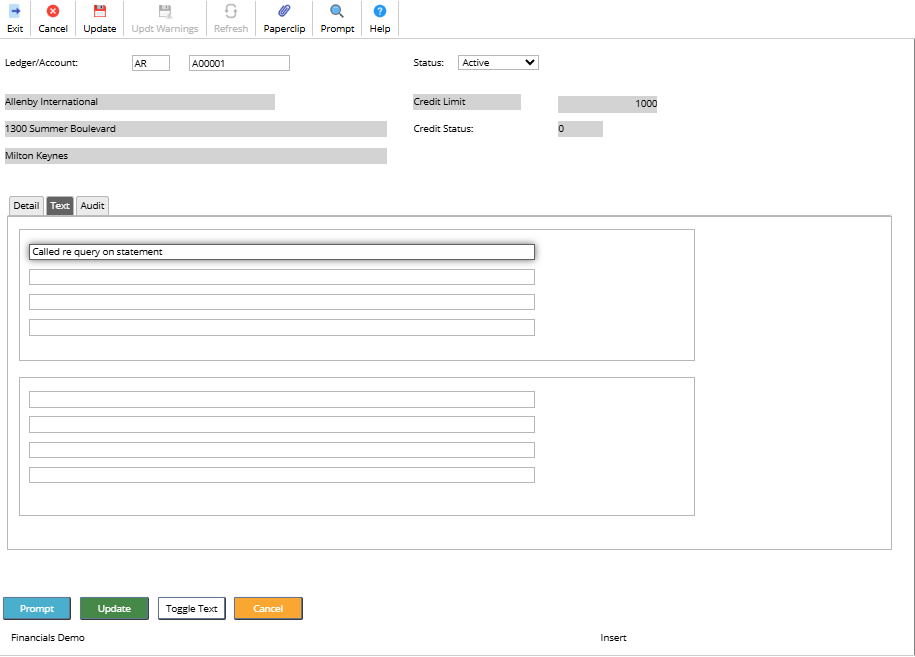

- Text describing the diary event.

- Contact Name, telephone number and e-mail address.

- Value and currency.

Select Update once complete.

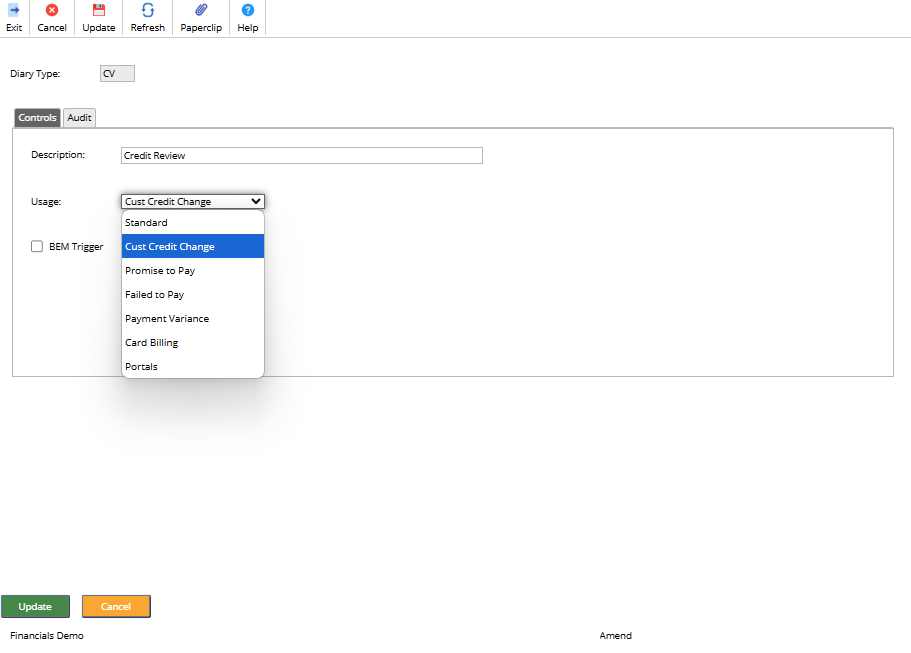

BEM Events in Diary

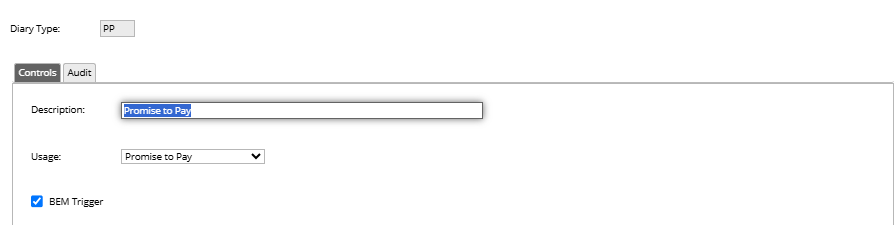

An attribute attached to Diary Types enables any type to be flagged to trigger a Business Event Manager (BEM) message. If the BEM trigger is set on, a BEM message will be invoked when the action date on the diary event is reached.

This facility enables flexibility in the generation of messages from the diary and can allow users to be proactive in the use of BEM for credit management.

To check diary types, access the following menus:

Systems Admin>Module Controls>Accounts Receivable Controls>AR Credit Management Controls>Diary Types

Click on OK to retrieve a list. Then use the View action against the code.

A further facility allows a user to specify a Diary Type with the Diary Usage indicator flagged as ‘Promise to Pay’. This diary type can be used to indicate that a customer has promised to pay a certain sum of money by a specified date. The diary event is monitored by BEM such that, if no payment is made (i.e. the cash has not been processed onto the customers account) between the date of the diary event and the Action Date, a Failure to Pay BEM message will be generated to prompt the action user or credit controller.

If only part of the payment is made against the value indicated on the diary event then a Payment Variance BEM message will be generated.

Automatic Diary Entries

Certain types of amendments made to the customer database may be automatically tracked and recorded in the Diary.

A specific Diary Type must be set up with the Diary Usage indicator flagged as Customer Credit Change. A diary event of this Dairy Type will be created automatically when one of the following amendments is made:

- Change to Credit Limit

- Change to Temporary Credit Limit

- Account placed in/removed from Stop Credit

- Account placed in/removed from Legal Hands

- Change to Credit Status

- Account is disabled or enabled

Content of the generated diary event will vary according to the change made to the customer account.