Release Notes 2025

December 2025

November 2025

October 2025

September 2025

August 2025

July 2025

June 2025

May 2025

April 2025

March 2025

February 2025

January 2025

Frequently Asked Questions!

How do I access field level help?

How do I see descriptions of codes in enquiry screens?

How do I make a user have read only access

Can I copy and delete lines in data entry screens?

Out of Office

Can I run a report to view security groups against my users?

How do I stop a user posting to prior and future periods?

Delete a payment run

Changing security access to a user

User setup requires multiple screens and is complicated!

De-allocate an AP Payment

How to stop over receipting of orders

Why has my transaction not appeared on the AP Payment run?

Download Templates

Useful information to include when raising Financials cases

Prevent users posting to specific balance classes

Hints and Tips!

General Ledger - Helpful how-to guides

General Ledger Data Entry

General Ledger Enquiries

GL Enquiries - Transaction Enquiries

GL Enquiries - Balance Sheet & Profit and Loss

GL Enquiries - Account Details

Trial Balance

Period and Year End Close

General Ledger Security

Accounts Payable - Helpful how-to guides

Accounts Payable Supplier File

Accounts Payable Data Entry

Log and Invoice/Credit note

Enter a logged Invoice

Enter a non order related Invoice

Order Related Invoice

Order Related Invoices with Mismatches

Order Related Invoice - Mismatch Scenarios

Mismatch Types

Invoice and Credit Note Matching

Accounts Payable Enquiries

Accounts Payable Transaction Maintenance

Accounts Payable Payment Processing

Accounts Payable Code Tables

Accounts Payable Reports

Accounts Receivable - Helpful how-to guides

Customer Maintenance

Enquiries

Cash Allocation

Data Entry & Contracts

Student Sponsor - Education sector

Credit Control

Credit Control Overview

Customer Statements

Diary Notes

Query Management

Interest Charges

Dunning Process

Credit Control Diary

Reporting within Financials

Student Sponsor - Education Sector

Purchasing Management - Helpful how-to guides

Fixed Assets - Helpful how-to guides

Prompt File - Asset Creation

Join Prompt File Items

Fixed Assets Period End & Depreciation

Revaluation

Disposals

Relife

Reconciliation process - Helpful how-to guides

Accounts Receivable Reconciliation Reporting

Accounts Payable Reconciliation Reporting

Daily Checks

Fixed Assets Reconciliation Reporting

General Ledger Reconciliation Reporting

Purchasing Management Reconciliation Reporting

Reporting

General Ledger Reports

Accounts Payable Reports

Accounts Receivable Reports

Sales Invoicing Reports

Fixed Assets Reports

Bank Reconciliation Reports

Import Tool Kit

Procurement Portal

Procurement Portal new User Interface

Navigation

Requisitions

Orders

Authorisation

Receiver

Invoice Clearance

Portal Administration

Procurement Portal - Teams Setup

Invoice Manager

Purchase Invoice Automation (PIA)

January 2026 Release notes

Deleting Supplier training data

Password Reset in Smart-Capture

Adding a New User - Smart Workflow

Resetting password - Smart Workflow

Purchase Invoice Automation

New User Interface

BPM

Request a nominal

Request a customer

Request a Sales Invoice

Request a management code

Create a Pay Request

Request a Supplier

Bring Your Own BI (BYOBI)

Collaborative Planning

Financial Reporting Consolidation

Air Approvals

Registering Air Approvals

Air Approvals Administration – Create Mobile User

Air Approvals Administration – Reset User’s Activation Key

Reviewing Approvals

Disable/Enable a User

Delete a User

Release Notes 2024

December 2024

November 2024

October 2024

September 2024

August 2024

July 2024

June 2024 Release

May 2024

April 2024

March 2024

February 2024

January 2024

API

Release Notes - Previous years

Contents

- All categories

- Fixed Assets - Helpful how-to guides

- Prompt File - Asset Creation

Prompt File - Asset Creation

Updated

by Caroline Buckland

Updated

by Caroline Buckland

The process

To create assets from the Prompt File. This guide utilises a journal but an Accounts Payable Invoice or indeed a Sales Invoice (used for disposals) could also be used to create an entry in the prompt file.

Access the Prompt file

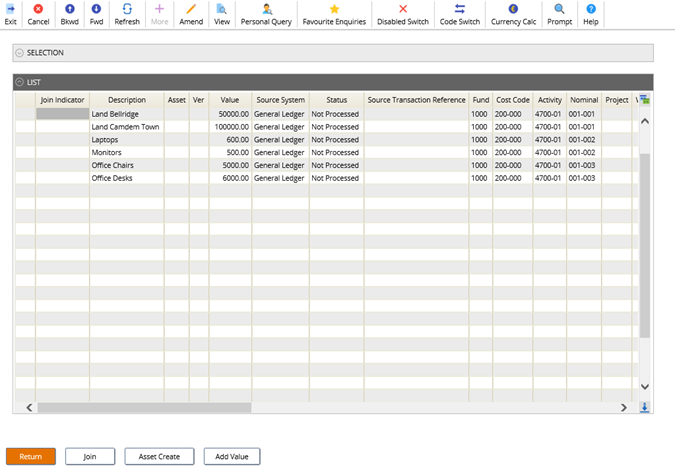

To access the Prompt file follow the menu options, Fixed Assets- FA Processes-Asset Maintenance-Prompt File-click on OK to retrieve a list of transactions.

Create the Asset

Click on the Asset you wish to create and click on the Asset Create

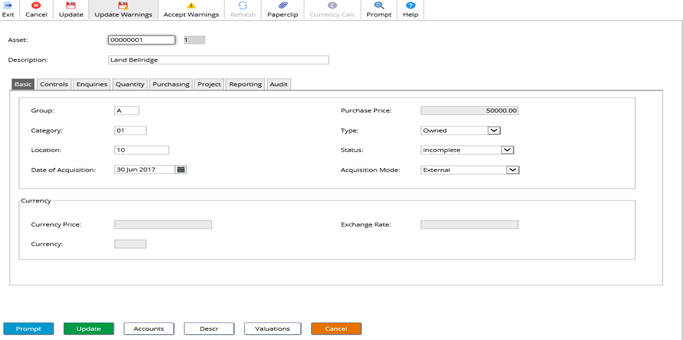

Press Enter on the Keyboard this will highlight the mandatory fields.

Asset Number – enter the Asset Number

Group – if this field has not defaulted enter a group

Category – if this field has not defaulted enter a category

Location – enter a location for the asset

Move through each of the formats to check the details are correct.

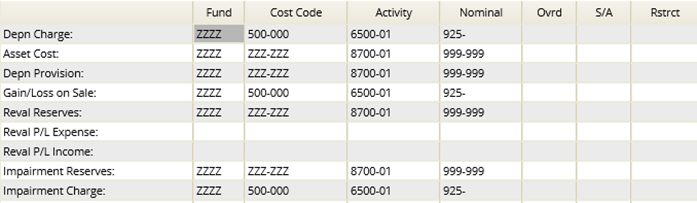

Assign GL Accounts to the Asset

Click on the Accounts button.

This will show which GL Accounts are posted to for Depreciation, Cost etc.

You can override these accounts.

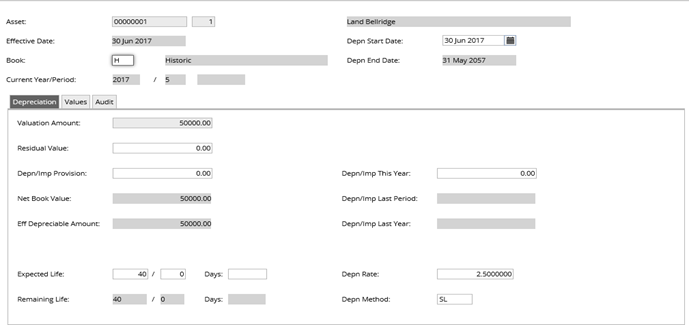

Valuation of Asset

Click on the Valuations button.

Press enter on the keyboard for the values to default.

The Valuation and Amount and Effective Date will default.

You may amend the Depreciation Start Date.

Update the Asset

When you have completed all the tabs, click Update.