Release Notes 2026

Frequently Asked Questions!

How do I access field level help?

How do I see descriptions of codes in enquiry screens?

How do I make a user have read only access

Can I copy and delete lines in data entry screens?

Out of Office

Can I run a report to view security groups against my users?

How do I stop a user posting to prior and future periods?

Delete a payment run

Changing security access to a user

User setup requires multiple screens and is complicated!

De-allocate an AP Payment

How to stop over receipting of orders

Why has my transaction not appeared on the AP Payment run?

Download Templates

Useful information to include when raising Financials cases

Prevent users posting to specific balance classes

Hints and Tips!

General Ledger - Helpful how-to guides

General Ledger Data Entry

General Ledger Enquiries

GL Enquiries - Transaction Enquiries

GL Enquiries - Balance Sheet & Profit and Loss

GL Enquiries - Account Details

Trial Balance

Period and Year End Close

General Ledger Security

Accounts Payable - Helpful how-to guides

Accounts Payable Supplier File

Accounts Payable Data Entry

Log and Invoice/Credit note

Enter a logged Invoice

Enter a non order related Invoice

Order Related Invoice

Order Related Invoices with Mismatches

Order Related Invoice - Mismatch Scenarios

Mismatch Types

Invoice and Credit Note Matching

Accounts Payable Enquiries

Accounts Payable Transaction Maintenance

Accounts Payable Payment Processing

Accounts Payable Code Tables

Accounts Payable Reports

Accounts Receivable - Helpful how-to guides

Customer Maintenance

Enquiries

Cash Allocation

Data Entry & Contracts

Student Sponsor - Education sector

Credit Control

Credit Control Overview

Customer Statements

Diary Notes

Query Management

Interest Charges

Dunning Process

Credit Control Diary

Reporting within Financials

Student Sponsor - Education Sector

Purchasing Management - Helpful how-to guides

Fixed Assets - Helpful how-to guides

Prompt File - Asset Creation

Join Prompt File Items

Fixed Assets Period End & Depreciation

Revaluation

Disposals

Relife

Reconciliation process - Helpful how-to guides

Accounts Receivable Reconciliation Reporting

Accounts Payable Reconciliation Reporting

Daily Checks

Fixed Assets Reconciliation Reporting

General Ledger Reconciliation Reporting

Purchasing Management Reconciliation Reporting

Reporting

General Ledger Reports

Accounts Payable Reports

Accounts Receivable Reports

Sales Invoicing Reports

Fixed Assets Reports

Bank Reconciliation Reports

Import Tool Kit

Procurement Portal

Procurement Portal new User Interface

Navigation

Requisitions

Orders

Authorisation

Receiver

Invoice Clearance

Portal Administration

Procurement Portal - Teams Setup

Invoice Manager

Purchase Invoice Automation (PIA)

February Release notes

January 2026 Release notes

Deleting Supplier training data

Password Reset in Smart-Capture

Adding a New User - Smart Workflow

Resetting password - Smart Workflow

Purchase Invoice Automation

New User Interface

BPM

Request a nominal

Request a customer

Request a Sales Invoice

Request a management code

Create a Pay Request

Request a Supplier

Bring Your Own BI (BYOBI)

Collaborative Planning

Financial Reporting Consolidation

Air Approvals

Registering Air Approvals

Air Approvals Administration – Create Mobile User

Air Approvals Administration – Reset User’s Activation Key

Reviewing Approvals

Disable/Enable a User

Delete a User

API

Release Notes 2025

December 2025

November 2025

October 2025

September 2025

August 2025

July 2025

June 2025

May 2025

April 2025

March 2025

February 2025

January 2025

Release Notes 2024

December 2024

November 2024

October 2024

September 2024

August 2024

July 2024

June 2024 Release

May 2024

April 2024

March 2024

February 2024

January 2024

Release Notes - Previous years

Contents

- All categories

- Release Notes - Previous years

- August 2023

August 2023

Updated

by Caroline Buckland

Updated

by Caroline Buckland

Sales documents file names change

Currently the file names for Sales Documents in the email sent to customers and shown in the attachment against the Document in Advanced Financials say “Sales_Invoice_nnnnn.pdf” (where nnnnn is the document reference) regardless of whether the document was an invoice or a credit note. Now the file is called “Sales_Invoice_nnnnn.pdf” when an invoice and “Credit_Note_nnnnn.pdf” when it is a credit note.

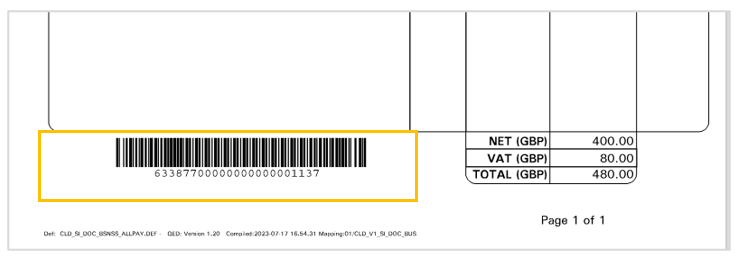

Barcode available on sales invoices

Barcodes are now available to be output on the bottom of sales invoices to allow customers to pay their invoices using PayPoint. The barcode will be output at the bottom of the invoice where the bank details currently reside.

If using a barcode and you still wish the bank details to be sent to the customer then a ways to pay document can be configured by Advanced Support which will email out with the invoice.

If this is a requirement, please raise a case with Advanced who will be able to configure this for you.

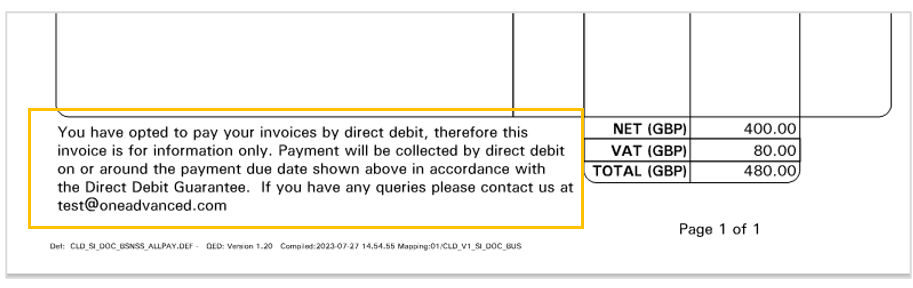

Direct Debit text on sales invoices

Some new text will now be output on the bottom of sales invoices if the invoice is to be collected by direct debit. This is dependent on the customer having an active direct debit mandate and the invoice not having the ‘Supress DD’ collection flag ticked.

If the invoice is not due to be collected by direct debit, then the usual bank details will be output. The direct debit text is shown below.

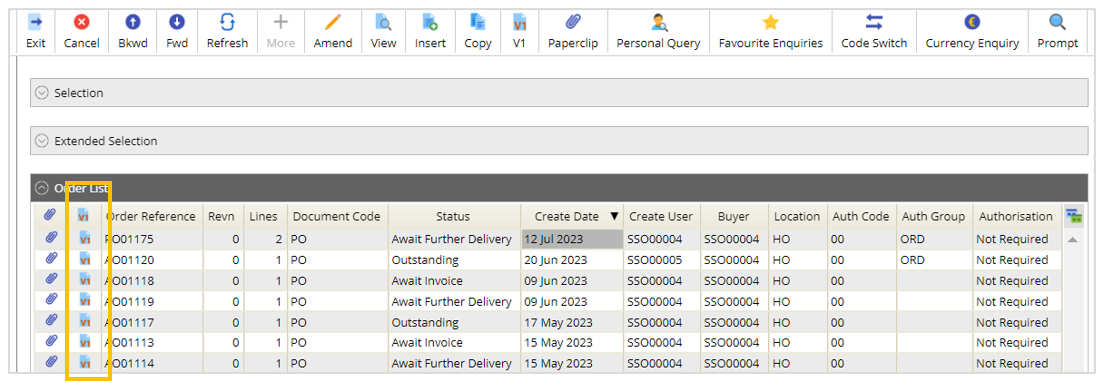

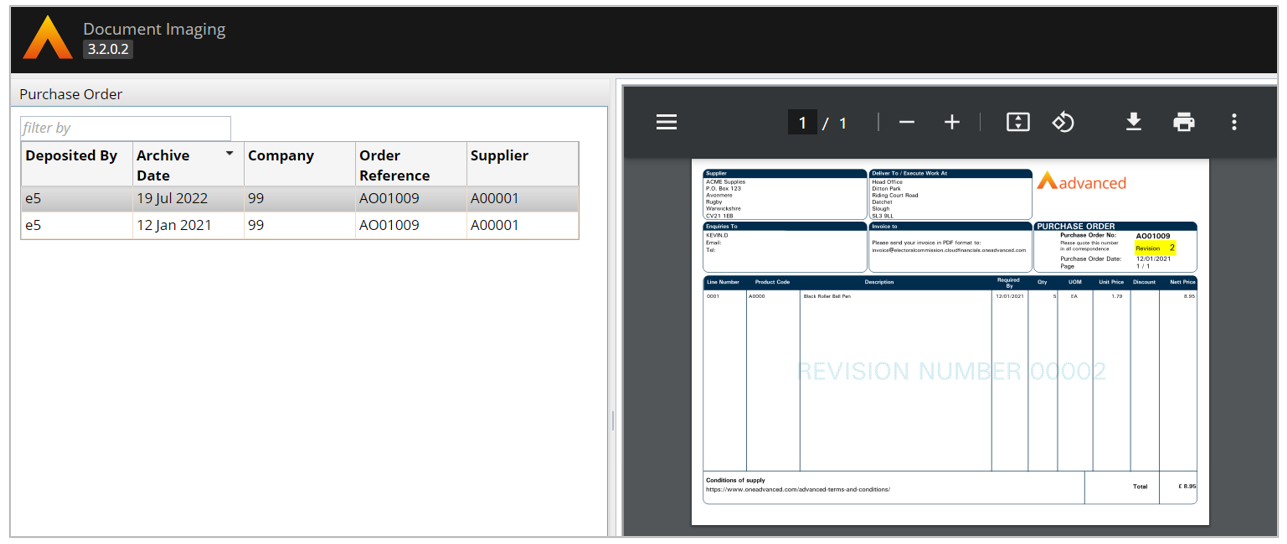

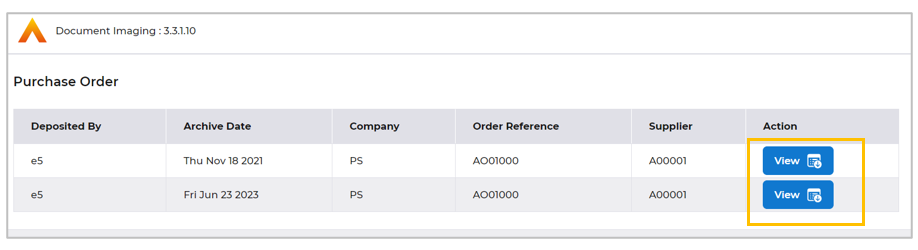

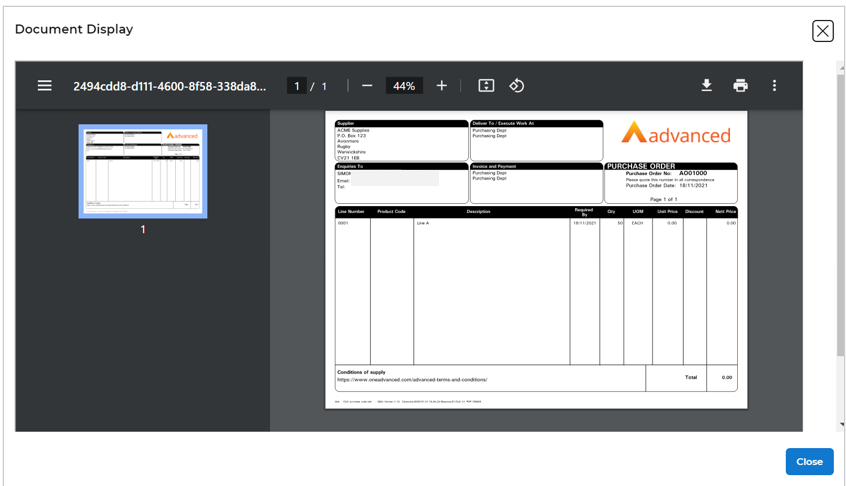

V1 review document changes

We have a new look and feel to the V1 document imaging. In a list screen where you would see the V1 image icon. The icon can be clicked in the usual way, you then select the view button to view the relevant document. This applies to all documents held in the V1 document imaging. Orders, Bacs Remittances, Sales Invoices etc.

Current

New

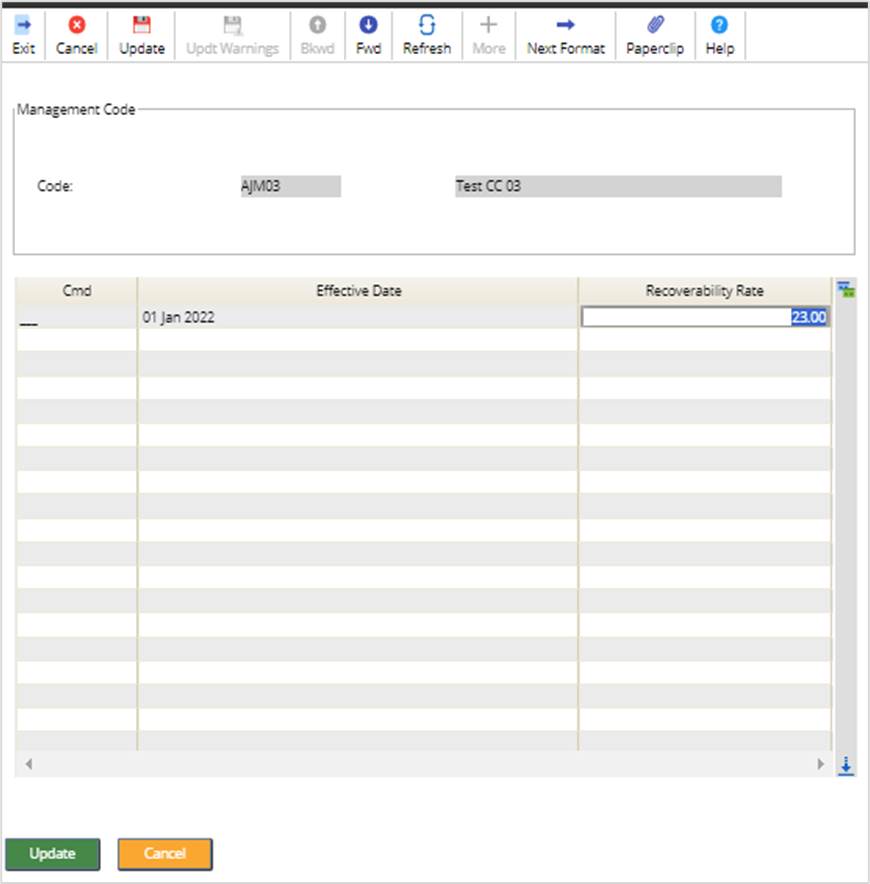

Partially exempt tax - extended functionality

Partially exempt tax is currently available in Advanced Financials to calculate partially exempt tax on Purchasing transactions. This month we have extended that functionality.

Current Solution

Currently non-recoverable VAT rates and treatment is controlled based on a management code segment. For example, the Cost Centre.

Against the Cost Centre the VAT recoverability rate is entered.

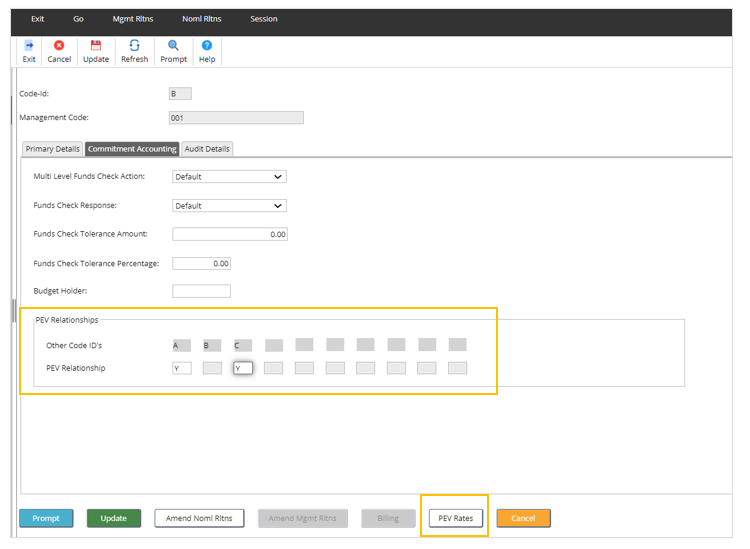

New Solution

This has now been extended to be able to be used against a combination of code segments e.g., cost code and nominal code.

Where an expense is applied it may have differing VAT treatment based on the business reason for the expense.

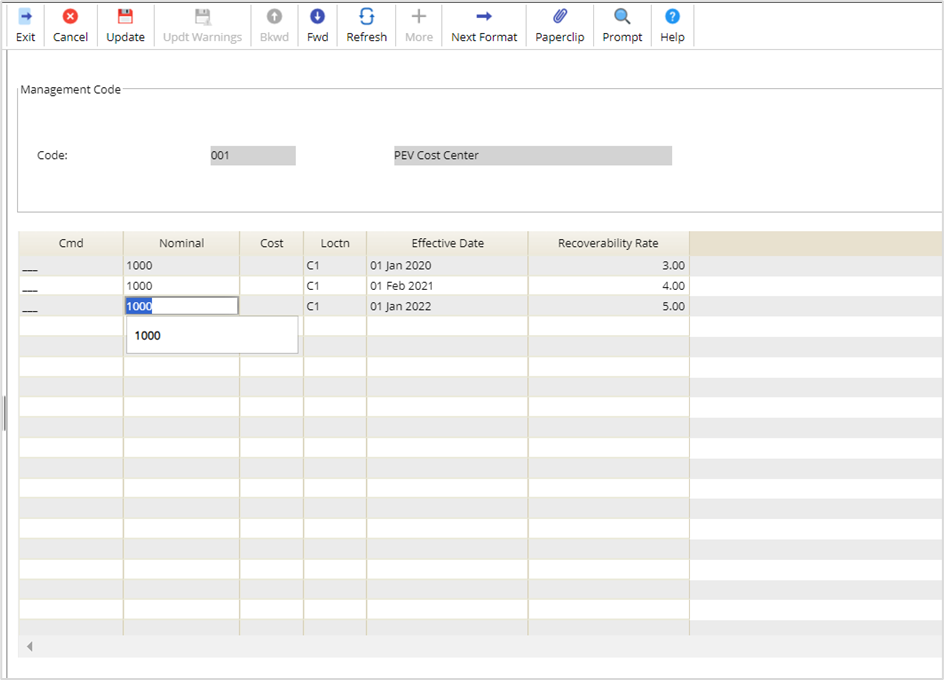

The management code edit screen MEBE has changed so it will be possible to identify per management code which other management or nominal segments are required to be applicable for the PEV calculation.

This relationship will only be available on management codes for the nominated Code ID for PEV as this will remain on the GL Controls. In this example the Cost Centre is the nominated account.

The cost centre can be amended and entering a Y in the Code ID to identify the other relevant segments for the PEV calculation.

Update the screen and access the code in amend mode again and select the PEV Rates button.

The rates and combinations can be entered as shown below.

To implement this new feature please raise a case with Advanced.