Contents

September 2022

Updated

by Caroline Buckland

Updated

by Caroline Buckland

Credit limits

The Accounts Receivable module now allows a credit limit to be maintained for each individual customer. This credit limit is used during Invoice entry (MODB) and checks whether it will exceed the allowed credit the customer has been allocated. Automatic updates can be performed to apply stop credit codes to the customer’s account when credit limits have been exceeded.

If a customer is part of a group/subsidiary association, a group credit limit can also be specified that represents the overall credit limit that is available to all customers in that association.

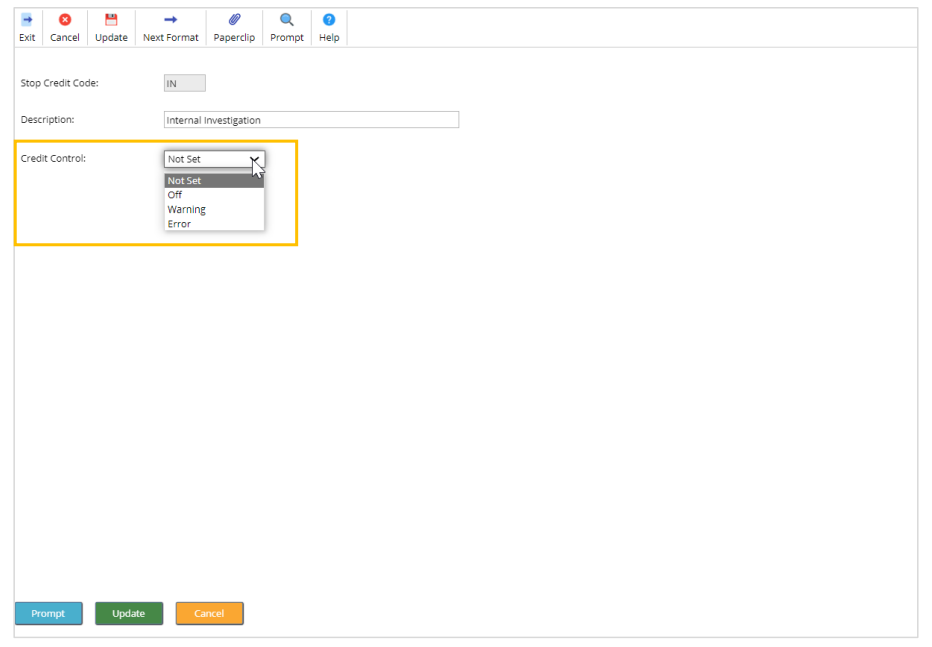

Setup - Stop Credit codes (MBZA)

There is a new credit control setting indicator available to set, if the stop credit code is entered on the customer account this setting will determine what message is displayed during data entry when the credit limit has been exceeded. If set to warning then you can proceed to update the document after accepting the warnings, if you set this to error, you will be unable to update the document.

Access the following menu options: System Admin>Module Controls>Accounts Receivable Controls>AR Credit Management Controls>Stop Credit Codes

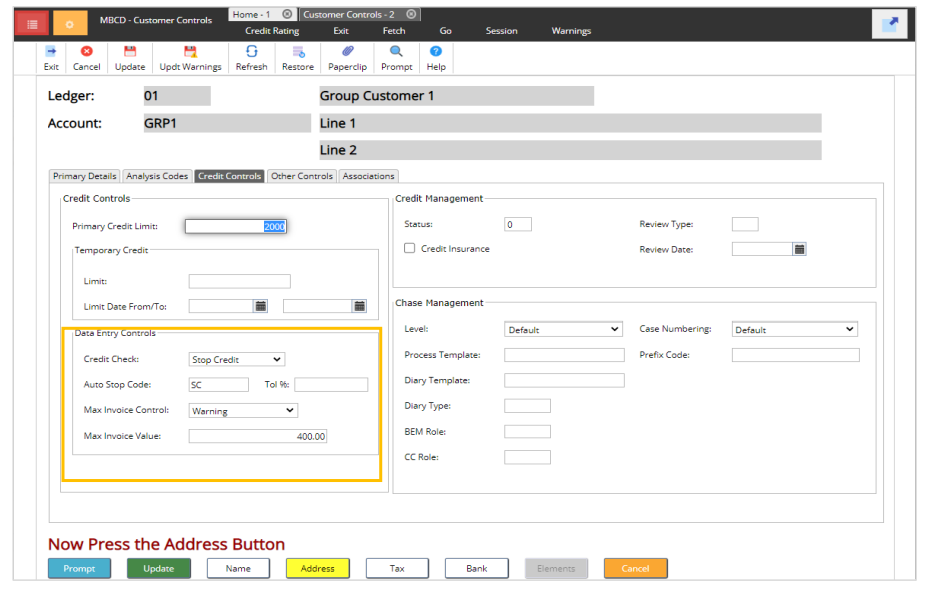

Setup - Customer Controls (MBCD)

The customer controls format has the following new controls available:

Access the following menu options: Accounts Receivable>AR Processes>Customers>Maintain Customers>Controls Format>Credit Controls tab.

The Credit Check option will override Sales Invoicing company controls to determine whether the credit control checks in Sales Invoicing are performed.

Default – will look at the settings on the Sales Invoicing Company Controls.

Off – the credit checks are not used for this customer.

Warning - this will allow you to enter a Sales Invoice, but you will have to accept the warning if the credit limit is exceeded.

Error - you will be unable to enter a Sales Invoice if the credit limit is exceeded.

Selecting the Stop Credit option will automatically set the Auto Stop Code for the customer when their credit limit has been exceeded. Setting this against the customer you can continue to allow the transaction to be raised and when the credit limit has been exceeded it will generate a warning that the customer will be placed on Stop Credit with an assigned Stop Credit Code. If a Tolerance Percentage has been entered, then this will only apply if the credit limit has been exceeded by this additional percentage. The stop credit code can be entered on the Primary details tab.

Auto Stop Code - It will only be populated when the Credit Check Indicator is set to Stop Credit and is used to automatically populate the existing stop credit code on the customer when the credit limit has been exceeded.

Tolerance % - It can only be populated when the Credit Check Indicator is set to Stop Credit and is used to calculate the tolerance percentage that the credit limit must be exceeded before the automatic rules for stopping credit apply.

Max Invoice Control – when entering an invoice if the value (including any tax) exceeds a defined amount (in base currency) either a warning or error will be issued.

- Not Required

- Warning

- Error

Max Invoice Value – maximum value when entering an invoice. If the invoice value (including any tax) exceeds a defined amount (in base currency) either a warning or error will be issued (depending upon the new Indicator).

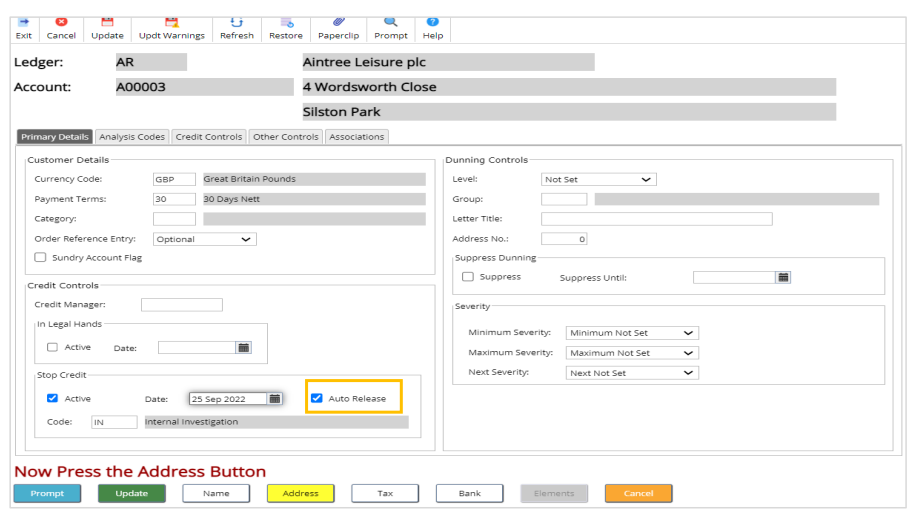

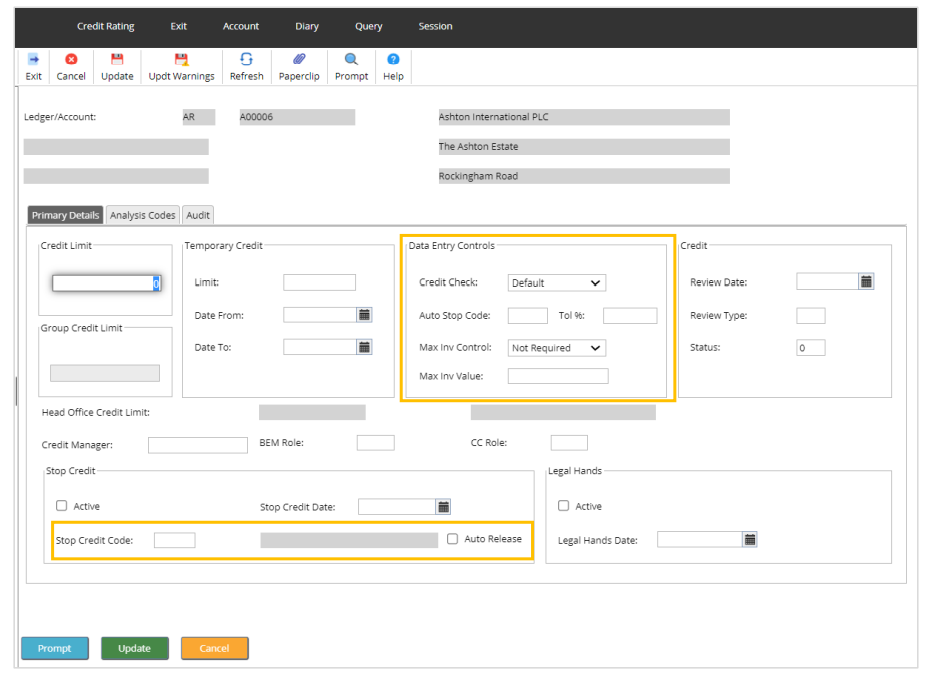

There is also a new flag added on the Primary Details tab.

Auto Release Customer Stop Credit Flag - allows for the automatic removal of the stop credit controls code when the customer’s credit limit has no longer been exceeded.

During data entry, this setting is used to determine if the stop credit controls are removed automatically when the balance of the customer is reduced by a payment that will cause the overall customer balance to now be lower that the agreed credit limit.

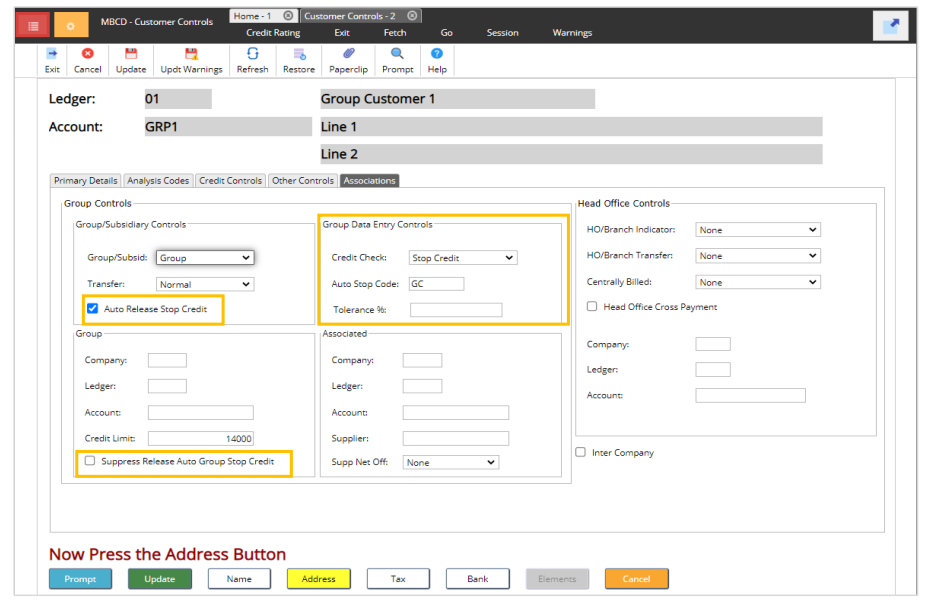

New customer controls format - associations tab

The Group Associations has the Check Credit controls, Auto Stop Code and Tolerance options available along with the addition of the following two flags.

Auto Release Group Stop Credit - this allows the automatic removal of the stop credit controls when the group’s credit limit has no longer been exceeded, for example when a payment has been made.

Suppress Auto Release - can be used when the group customer has the Auto Release Group Stop Credit Flag set to release all customers in the association, but the organisation requires that certain customers in the association are not automatically released.

Setup Credit limit (MBFR)

The controls that are created on the Customer Controls screen can also be updated from this screen.

Access the following menu options: Accounts Receivable>AR Processes>Credit Controls>Credit Control List> Access the Primary Details tab to locate the Data Entry Controls.

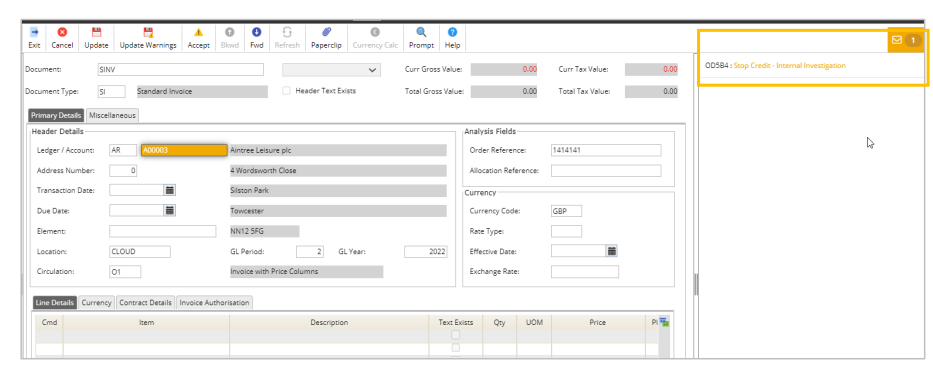

Data entry - Insert Invoice/Credit Note (MODB)

Example of the warning and error message retrieved when inserting a new Sales Invoice.

Access the following menu options: Accounts Receivable>AR Processes>AR Data Entry>Insert Invoice/Credit Note

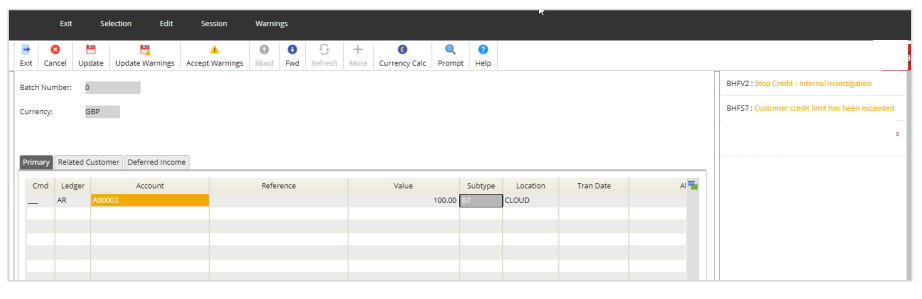

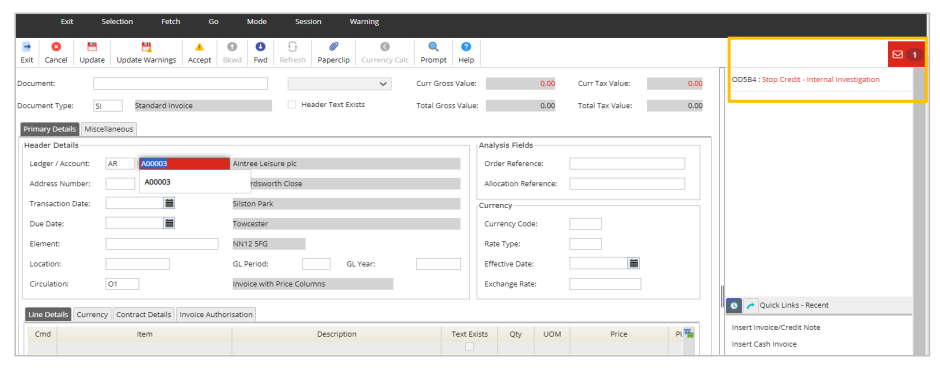

Data entry - Cash adjustment entry (MBHB)

Example of the warning message retrieved when entering a cash adjustment, only warning messages will be displayed on this screen.

Access the following menu options: Accounts Receivable>AR Processes>AR Data Entry>Cash/Adjustment Entry