Contents

Dunning Process

Updated

by Caroline Buckland

Updated

by Caroline Buckland

Credit Control & Dunning Letters

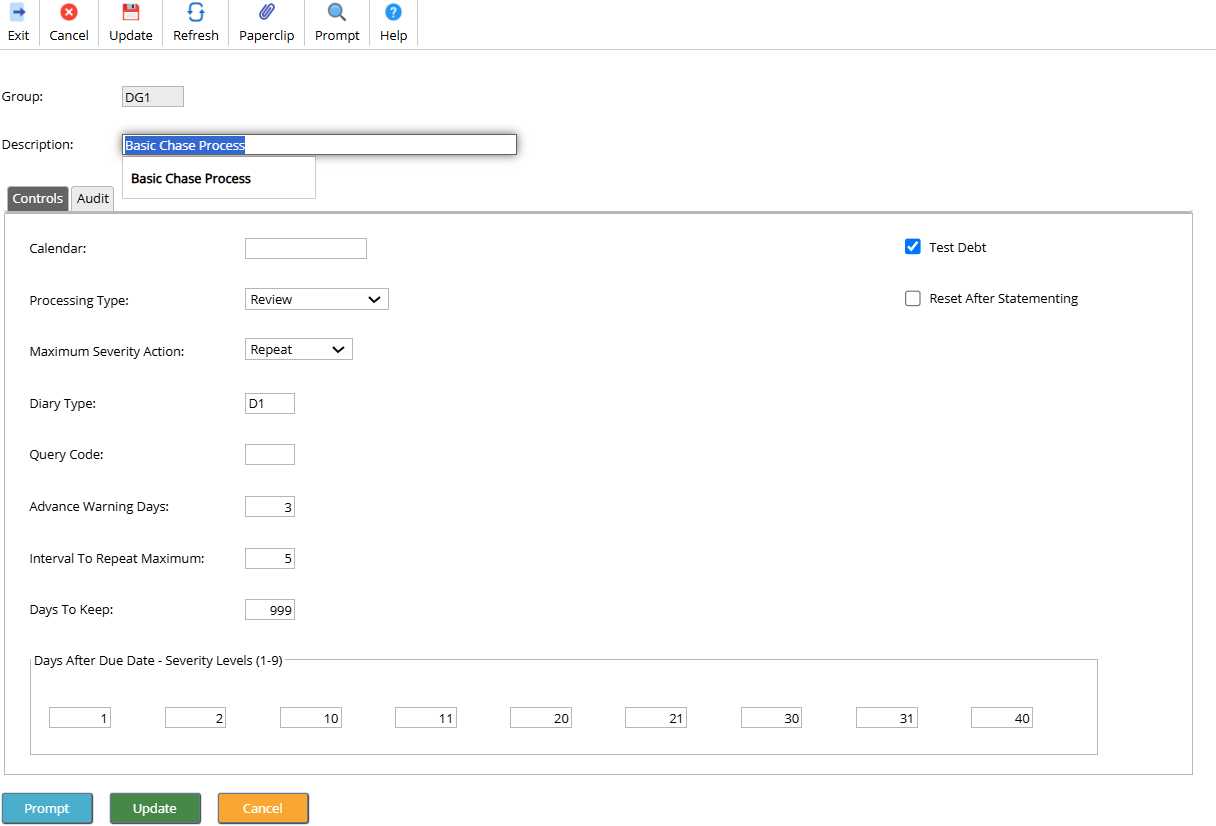

Dunning Groups determine how customers with overdue debt are to be chased, i.e. how often the recovery/chase letters are to be sent out and if an automatic diary event will be generated.

Dunning can be at account, transaction and consolidated level.

The next dunning severity level due is not a progression of the last level but is determined by the overdue age of the oldest transaction. This means that, if the oldest transaction is settled between dunning runs, then the dunning cycle can reset to a lower severity level than previously, depending on the age of the next oldest transaction.

Dunning controls are separated into two areas:

· Dunning Groups

· Dunning Formats

Before dunning can be set up, the function must be flagged as in use in Company Credit Controls, this should be part of your configuration.

Setup

Dunning Groups

Dunning groups would have been setup during your implementation.

Dunning Groups define how dunning will process letters for a customer.

Calendar

An entry in this field is optional, but if nothing is entered, the system assumes ‘every day’.

Processing Type

This can be set to:

- Immediate

Only one process is submitted to extract and print the letters. This will be for Account level dunning and Transaction level dunning.

- Review

An additional process must be submitted after either Account or Transaction level dunning to print the extracted letters.

- Authorise/Review

Letters must be authorised first and then the process to print the extracted letters.

Maximum Severity Action

This field determines the action to be taken when the customer’s maximum severity is reached. This could be:

· No further action.

· Maximum severity letter repeated.

· Dunning cycle is reset to the minimum severity for the dunning group.

Diary Type

If you wish the system to automatically generate a diary event on the customer account when a dunning severity letter is produced then enter a valid Diary Type code.

Query Code

Optional, enter a query code that will trigger the automatic creation of a memo transaction query.

Advance Warning Days

A number of days can be entered in this field which will extract dunning letters prior to the printing date so they can be reviewed on-line using the Dunning List option from the Credit Control Menu, in order that amendments may be made.

Interval To Repeat Maximum

You can enter the number of days between repeating the maximum severity level if the second bullet above is selected.

Days To Keep

If you are using 2 stage dunning (Review or Authorise/Review), this field can determine the number of days letters are to be retained before deletion. After the days entered has expired, a process will be submitted for the deletion. If set to 0, then the print process will automatically delete them after printing.

Test Debt

If flagged, will test the customer’s debt and, if the total debt is 0 or in credit, a dunning letter will not be produced.

Reset After Statementing

If this flag is set then the transactions extracted will return to their minimum dunning severity when the dunning process is ran.

Days After Due Date

There are 9 severity levels available; the number of days after the due date must be entered for the relevant number of levels that you are planning to use.

Example screen.

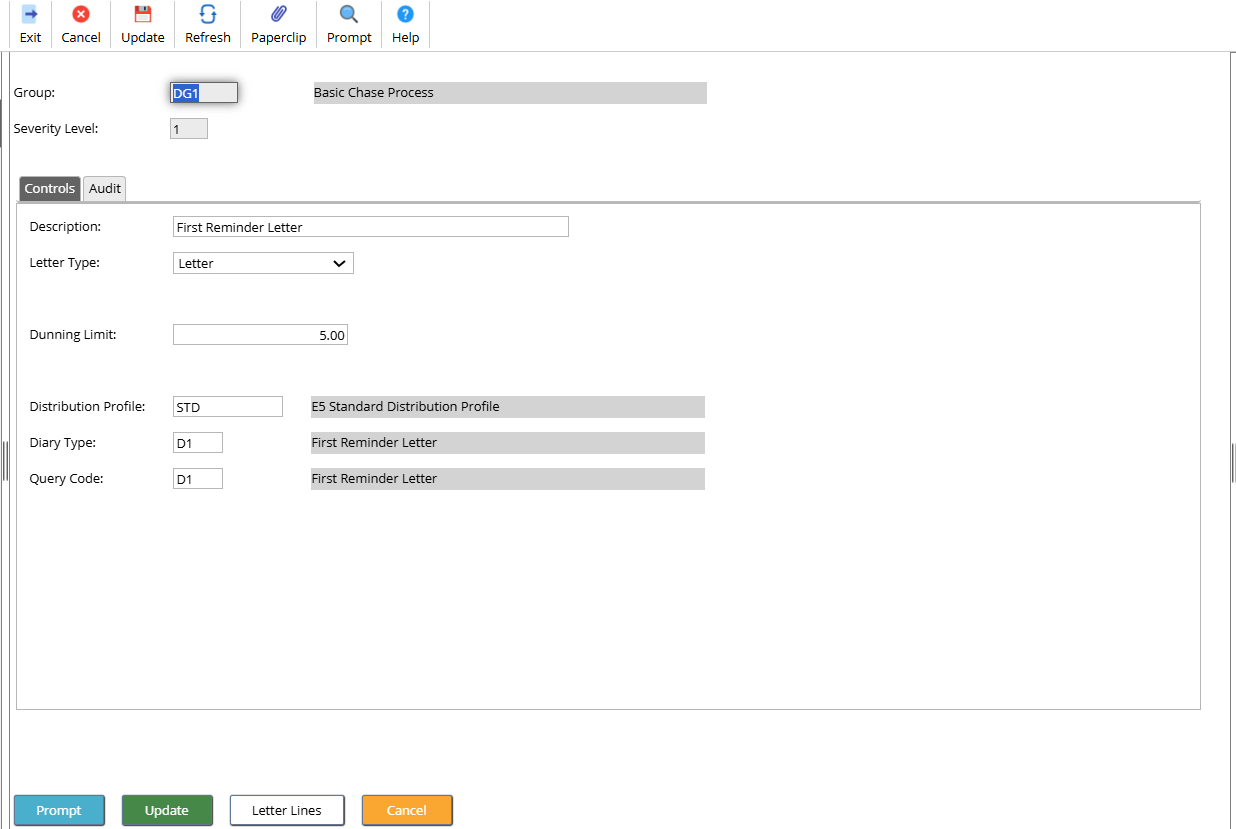

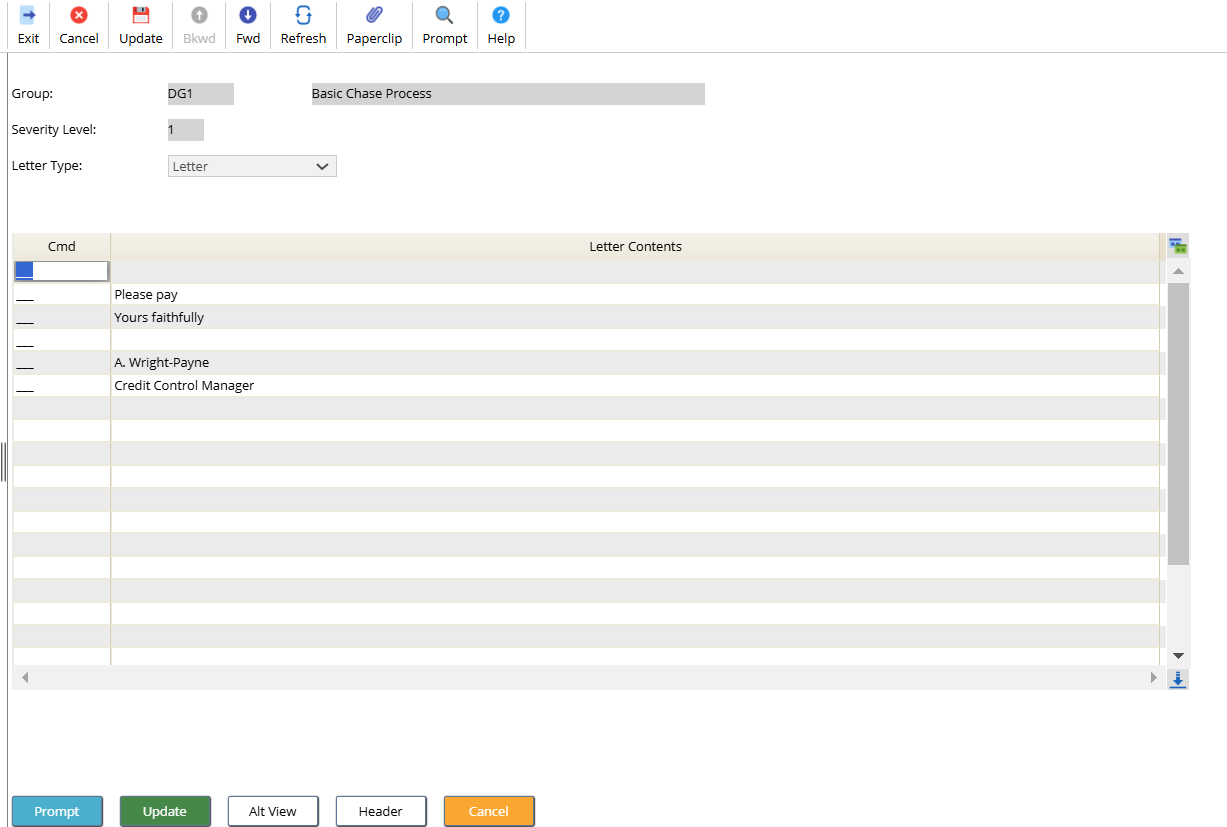

Dunning Formats

Menu access: Systems Admin>Module Controls>Accounts Receivable>Dunning Formats

Dunning Formats determine the output to be used and also the dunning letter text. You must create a letter for every severity level set in the Dunning Group.

Dunning Limit

The entry in this field defines the minimum amount by which an account must be overdue before a dunning letter will be created. Normally set at the level that is not cost-effective.

Letter Type

Defines the output to be one of the following:

Letter - print dunning text as a letter. |

Message - print dunning text as a message on customer statements. |

Record - write dunning text to a report file for reporting purposes or customised letters. |

Record/Letter - print dunning text as a letter and write dunning text to a report file. |

Internal - print dunning text as a memorandum for internal use only. |

Diary Type

An entry at this level will override the default entered at dunning group level.

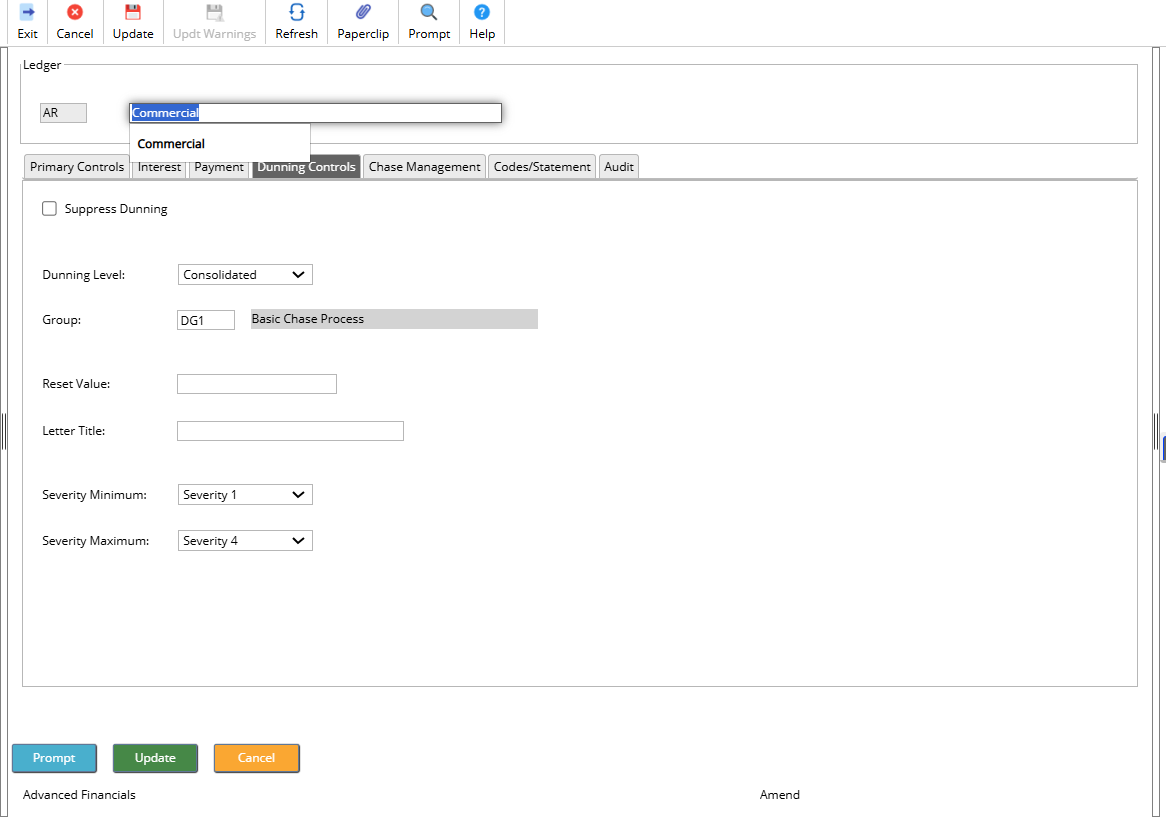

Ledger Level Controls

The Ledger Controls will have already been setup for you.

Dunning Level

This field determines the level of dunning to be used:

· Account Level

· Transaction Level

· Consolidated Transaction Level

Dunning Group

The default dunning group must be entered for all customers in this ledger. This can be overridden at Customer Controls and Transaction Legend level.

Minimum/Maximum Severity Levels

Values must be entered in these field but can be overridden at customer and transaction levels.

Suppress Dunning

If flagged, then all customers in this ledger will be suppressed from dunning. If left blank, dunning can be suppressed at customer level but an ‘until’ date should also be entered.

Dunning Reset Value

Only applicable for account level dunning.

Dunning Letter Title

A standard letter title may be entered as a default for all customers, for example, ‘Dear Sir/Madam’. A more personal title can be entered at customer level overriding the ledger default. If entries are entered in either or both of these fields, then title should not be entered as part of the dunning format text.

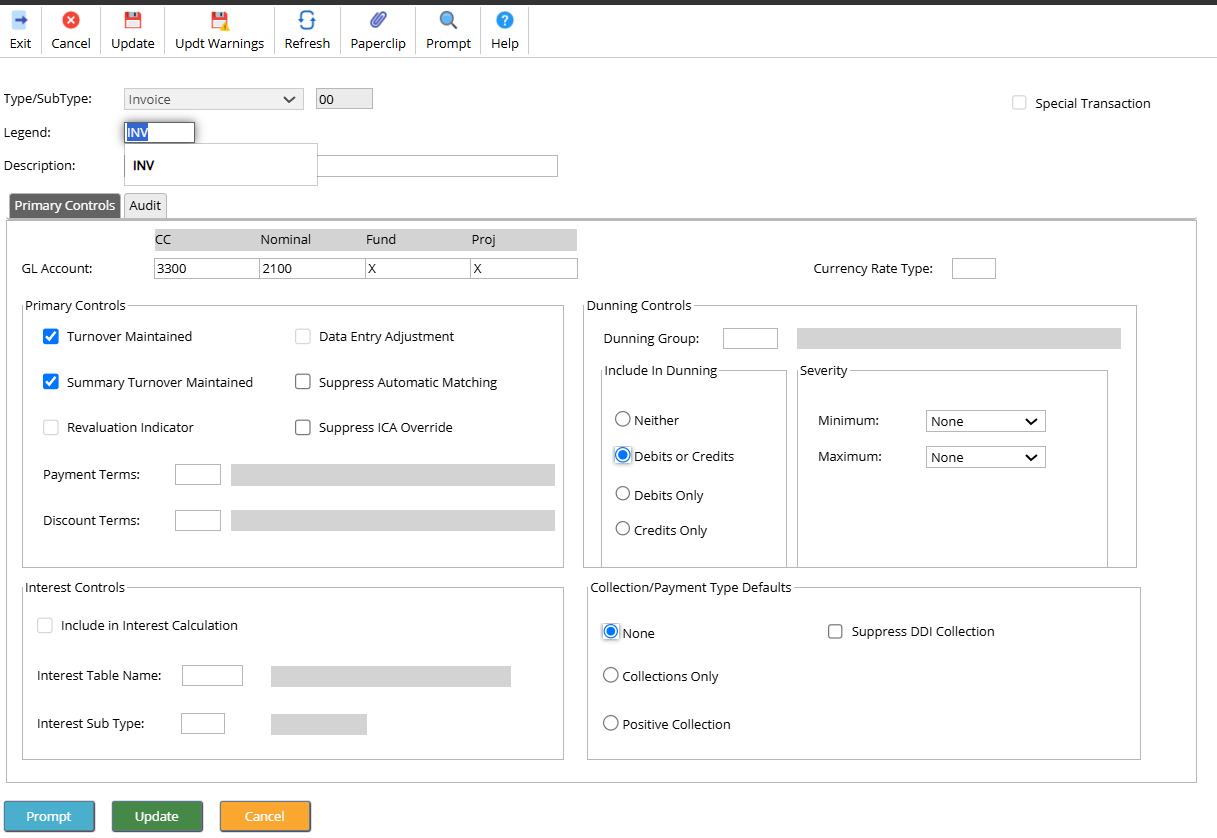

Dunning can be suppressed at transaction legend level

Dunning can be supressed at Transaction Legend level.

Access the following menus: Systems Admin>Module Controls>Accounts Receivable Controls>AR Data Entry Controls>Transaction Legends

The dunning controls format can be set to be included in dunning or not.

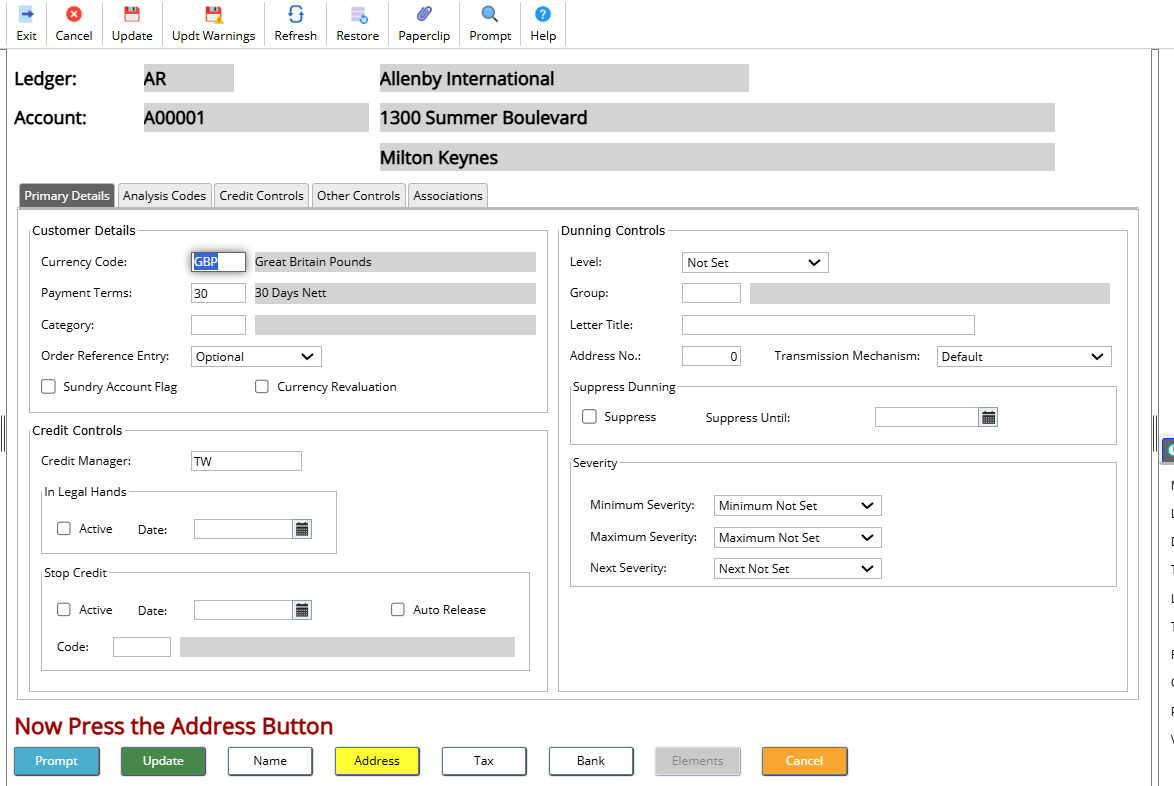

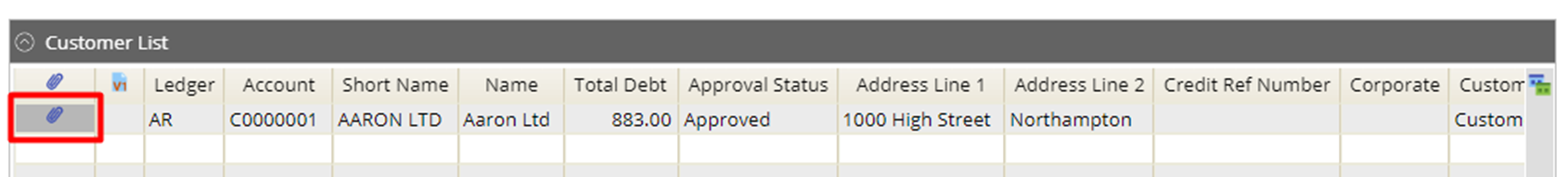

To control this at Customer level access the following menus:

Accounts Receivable>AR Processes>Customers>Maintain Customers

Locate your customer and then use the view or amend action.

Access the Controls tab to view or amend the dunning controls.

Processing

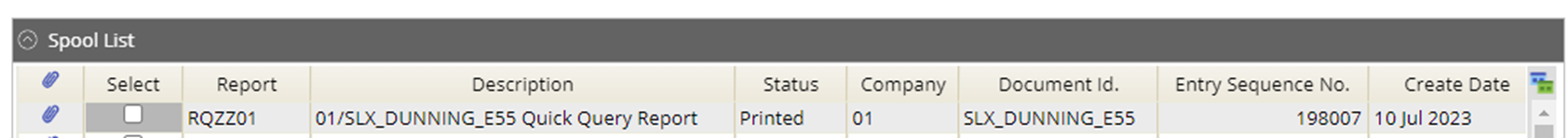

Dunning is ran automatically overnight as part of your batch schedule.

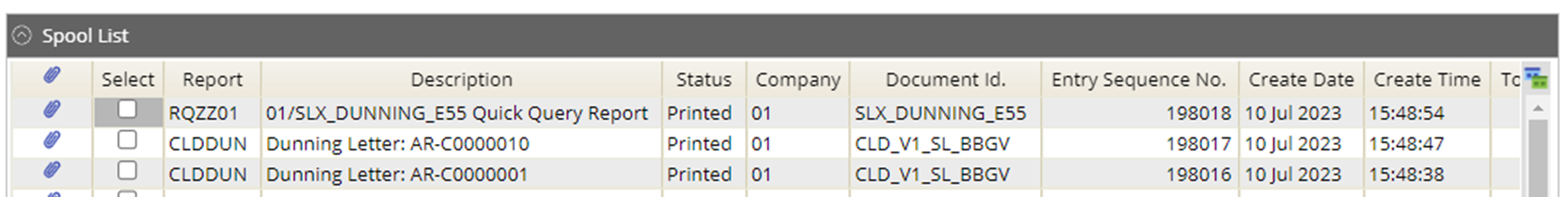

You will be able to see the entries in the spool.

Systems Admin>Spool

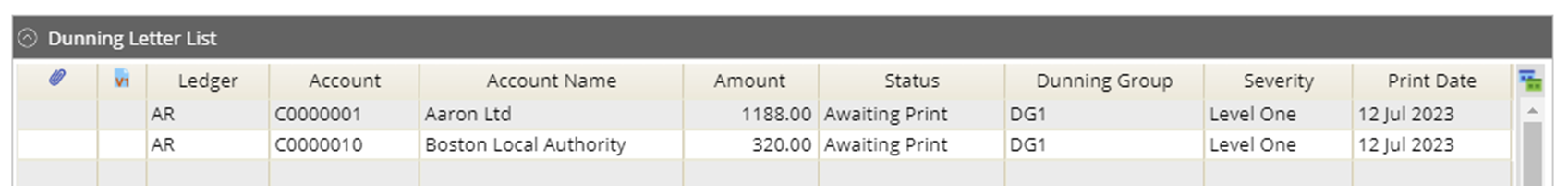

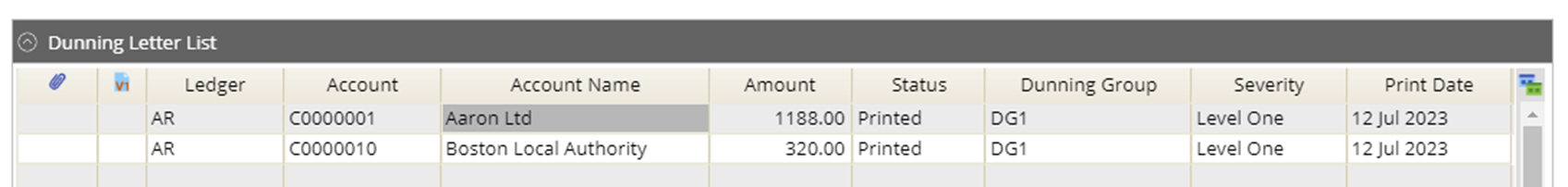

This will also create entries in the Dunning Letter list.

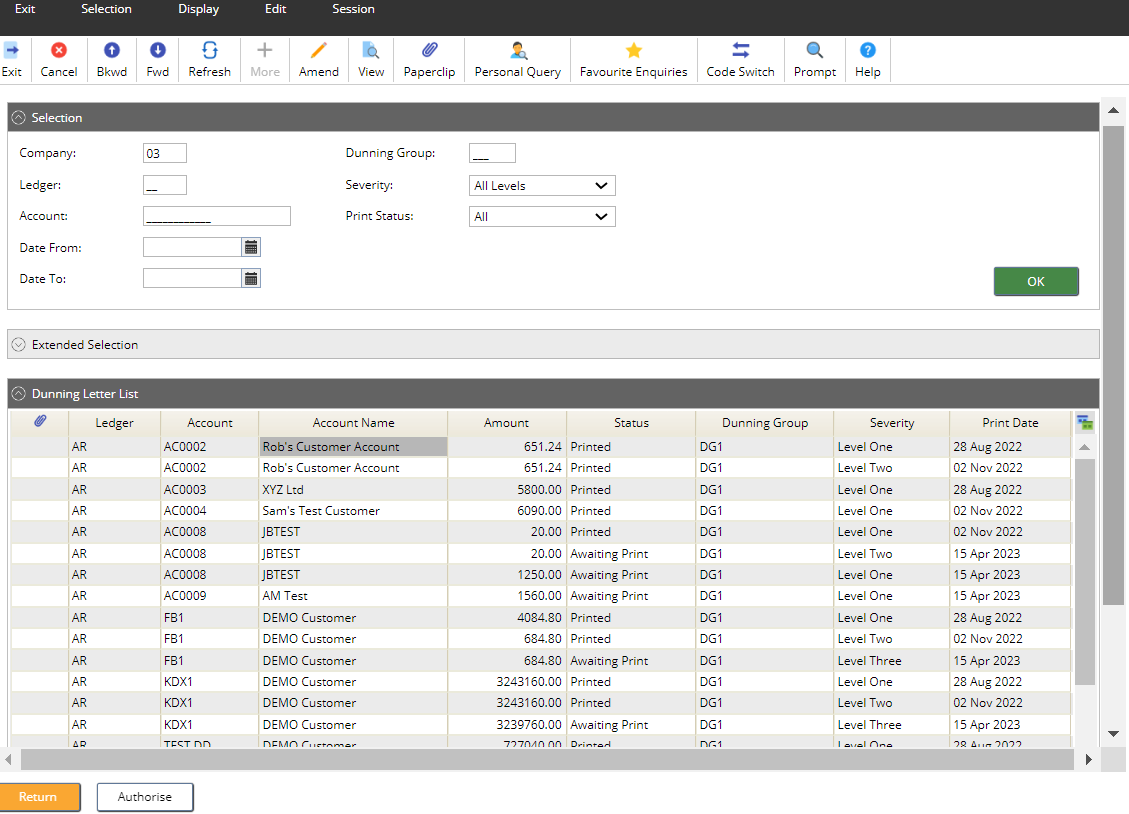

Accounts Receivable>AR Processes>Credit Controls>Dunning Letter List.

Click on OK to retrieve the full list.

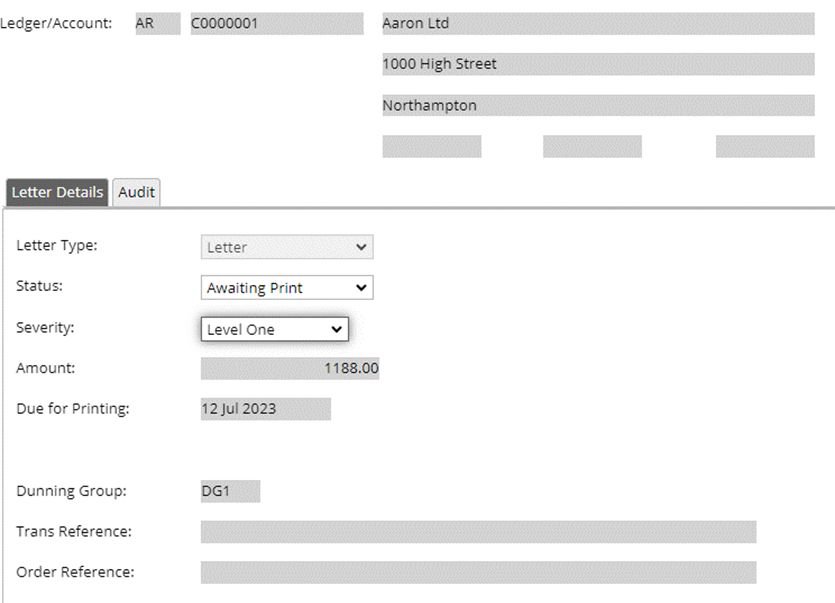

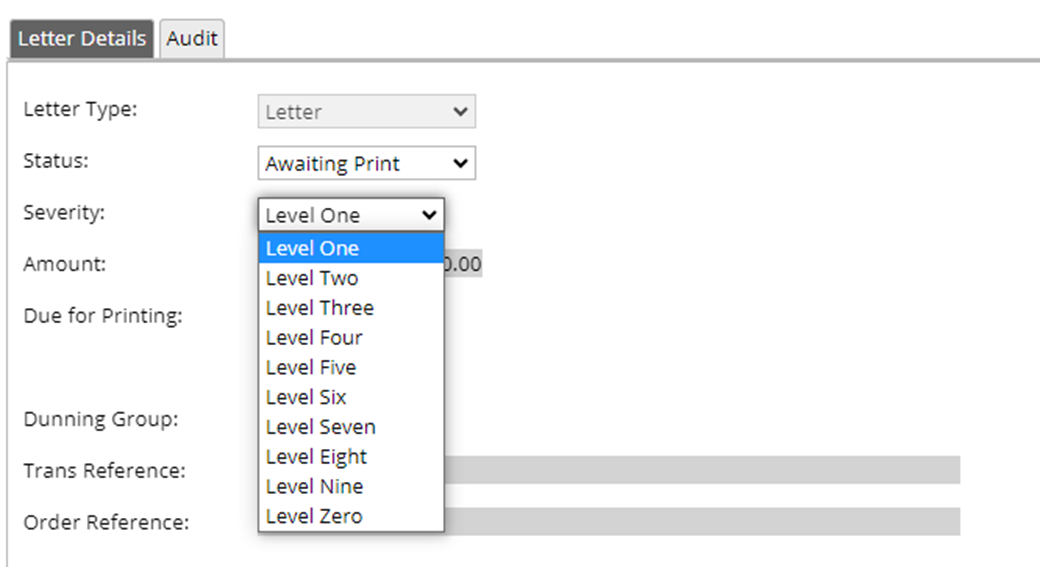

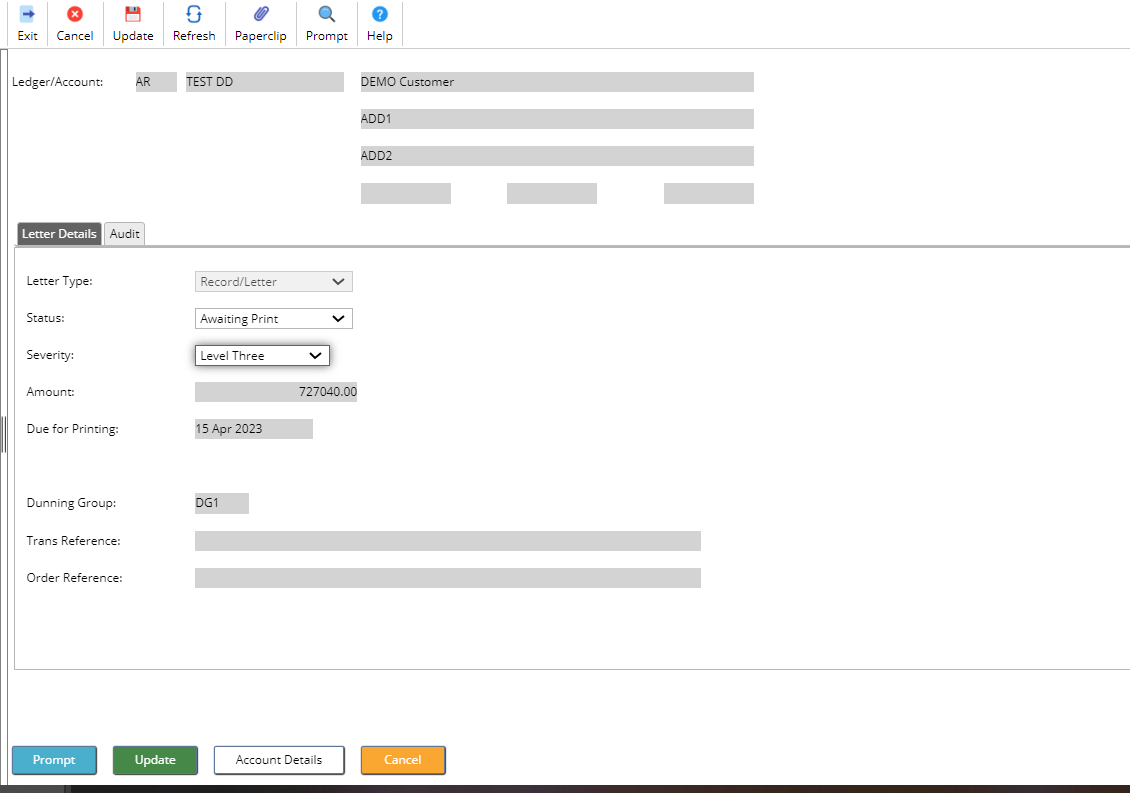

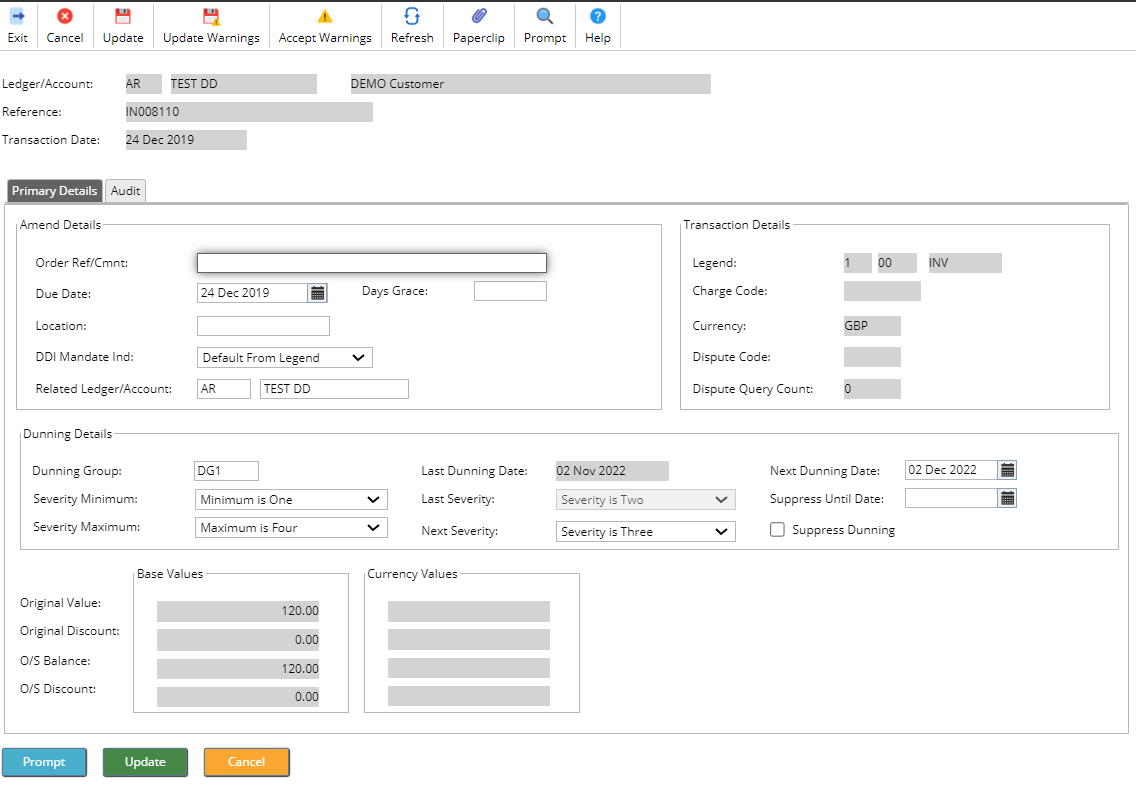

You can amend each entry to view the following details.

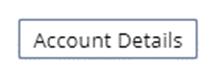

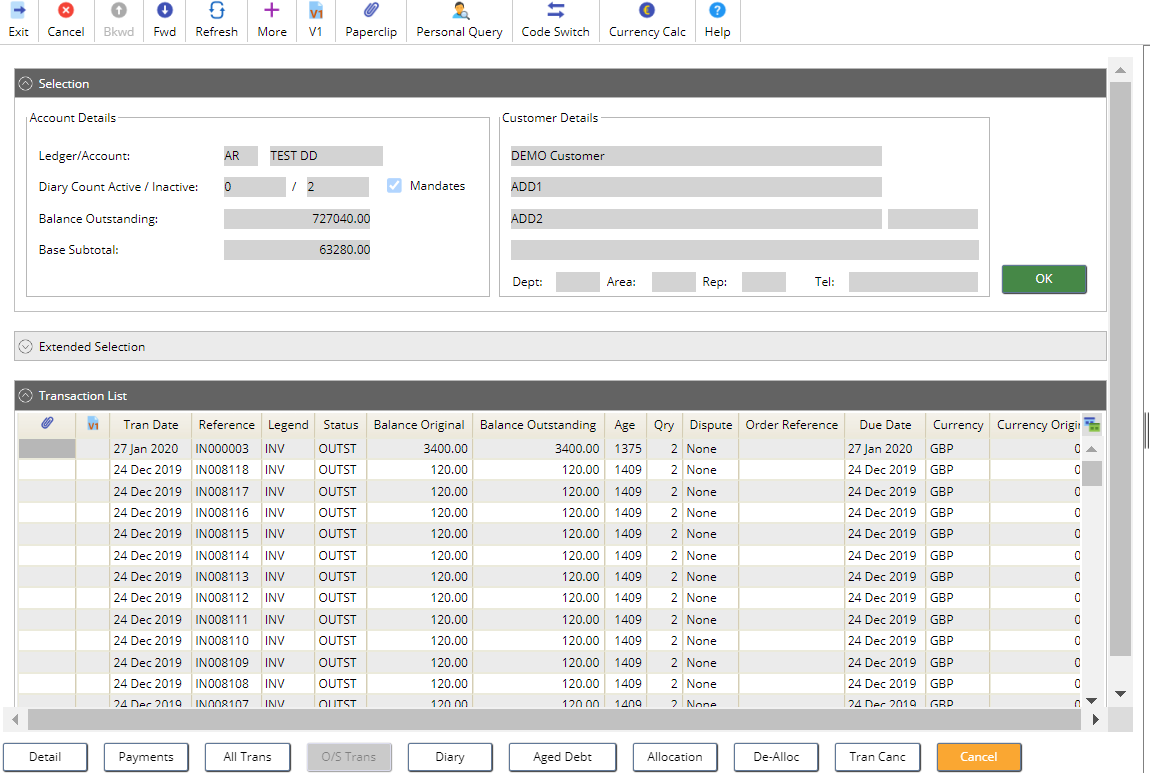

Select the Accounts Details button to view the transactions on the account.

If you return back to the Dunning letter list you can change the status of the dunning letter (if this hasn't already been printed)

Change the Status.

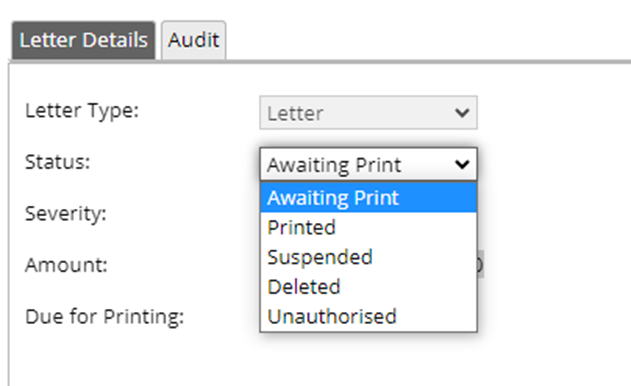

Change the Severity.

The status of deleted will not stop the dunning letter being created again overnight, unless you set the customer controls to Suppress Dunning letters.

Once you have reviewed the Dunning Letter list, the overnight batch schedule will create the dunning letters print/email.

You can view the entries on the spool.

The Dunning letter list will have been updated.

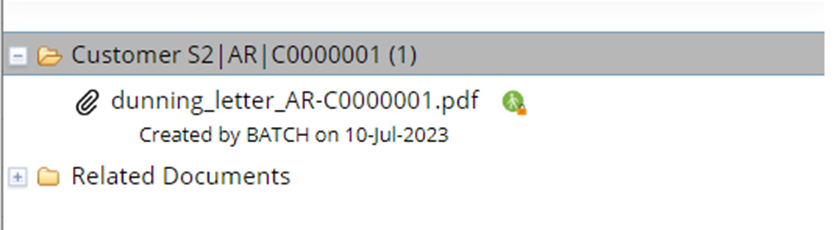

The Dunning letters will also be available from the Maintain Customers screen.

Resetting Letters

To Reset the Dunning Details when Dunning is set to Consolidated.

Access the following menus:

Accounts Receivable>AR Processes>Credit Controls>Dunning Letter List.

You can either enter a specific ledger and customer or just click on OK to retrieve a full list of letters.

Double click on a letter line to Edit.

Click on Account Details button, This will open the Account Details and show the transaction details.

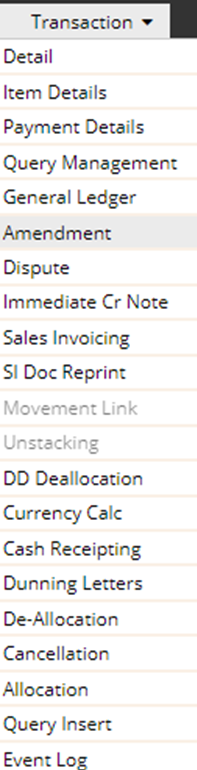

Select Transaction>Amendment by using the right-click action:

In the middle of the Primary Details sub tab, you will find Dunning Details.

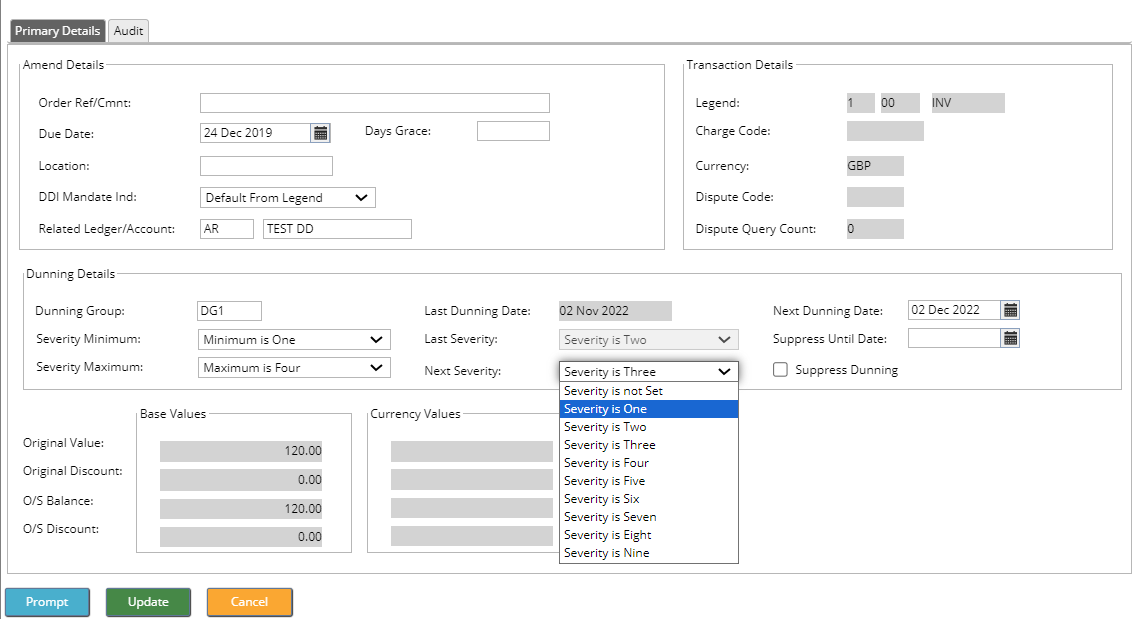

Here you can change the Dunning Details including Next Severity:

Here you can reset the next Severity back, for example, to Severity is One:

Once completed, click on Update.

You can also edit the transactions via Transactions By Customer, it is the same process of editing the Transaction then selecting the Amendment to change the dunning details.