Contents

Customer Enquiries

Updated

by Caroline Buckland

Updated

by Caroline Buckland

The process.

Allows the user to enquire upon All, or Outstanding transactions for the selected customer account(s). At Account level, the user can access, for example, the Diary and Customer Maintenance; at Transaction level, the user can access information such as item line details, payment details and query management.

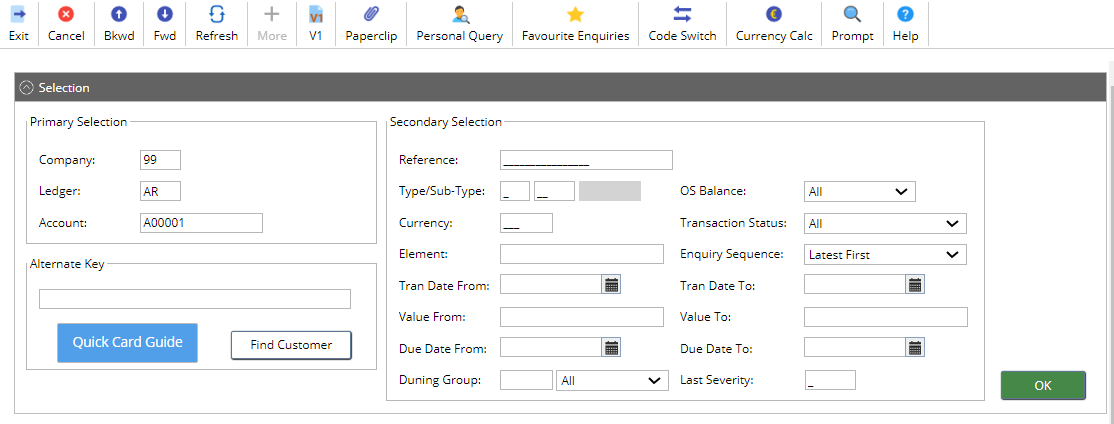

1. Selection Criteria

To access the customer enquiry screen: Accounts Receivable - AR Enquiries- Transactions Enquiries – Transactions by Customer

Enter a Ledger and Account number, click on OK once complete.

If you hover over a field and see that your cursor has changed to a question mark, it means that this field is promptable, and you can use Prompt to help find the code.

Primary Selection: you must enter the Account number of the customer that you wish to enquire upon

Secondary Selection: optional you can enter one or more of the fields to tailor your enquiry to specific transactions

Action Buttons: the buttons at the bottom of this window are a short cut to actions you may want to perform for this customer account

The account details screen displays details of all transactions held on a given customer’s account. All transactions are stamped with the update date, time and user, and the create date and user.

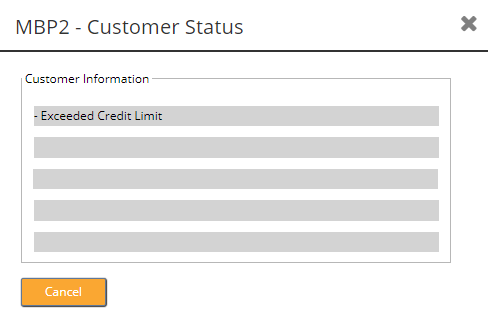

On entry to the customer account display, a pop-up window may also be displayed to indicate one of the following conditions on the account:

● Account Disabled

● In Stop Credit

● In Legal Hands

● Exceeding Credit Limit

It is only an information window so by clicking on the Cancel button the window will disappear to allow enquiries to be performed.

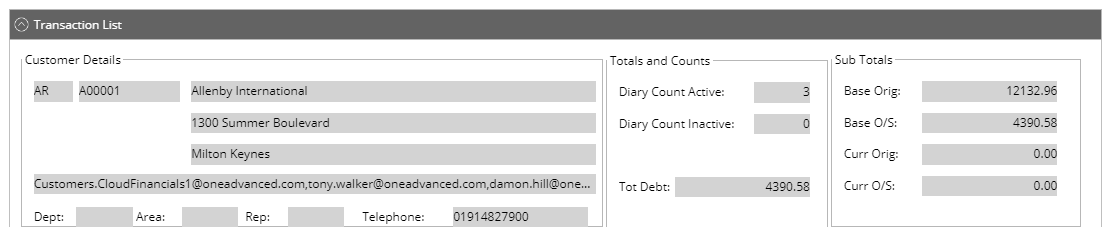

2. Customer Account Details

Summary details are shown for the customer account including;

• Customer name and contact details

• Information on outstanding balances

• Details of Diary Notes held for this customer

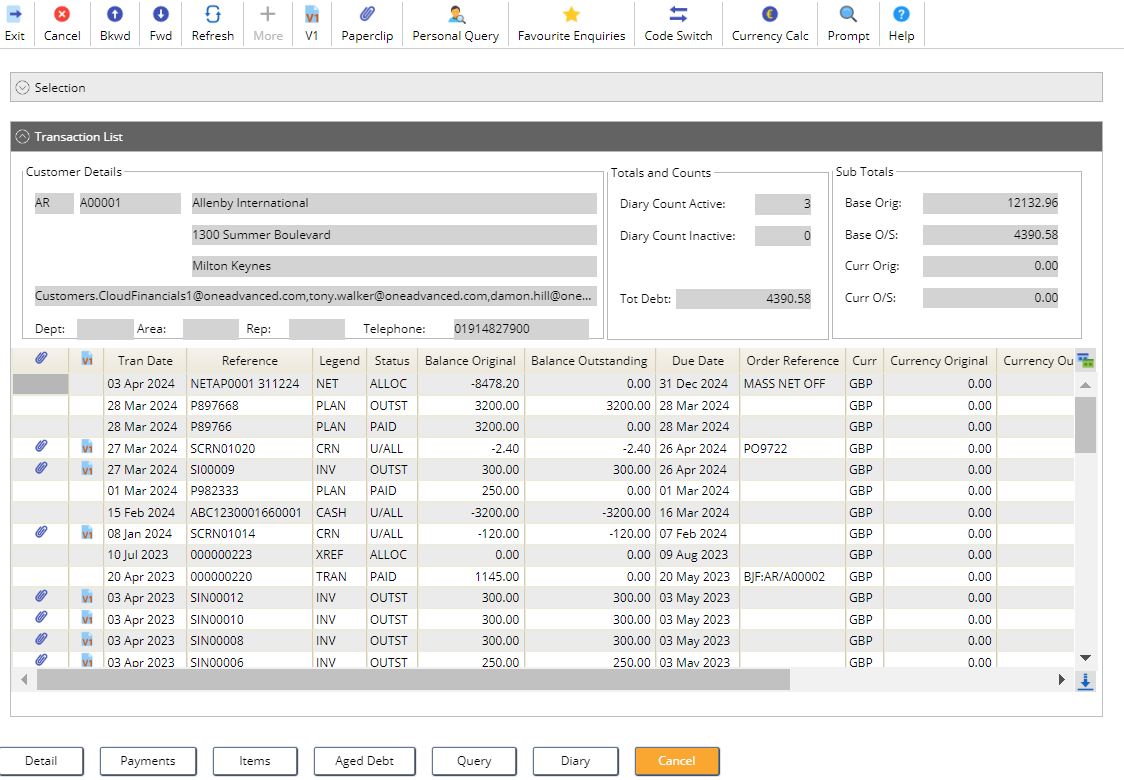

3. Transaction List

Transactions are listed according to the selection parameters entered.

4. Transaction Actions

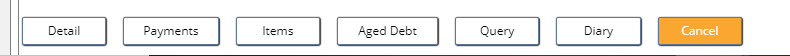

Once a transaction is highlighted then these buttons are available to perform further enquiries on the transaction

Detail

Displays more detailed information about the transaction such as due dates, queries and disputes raised, dunning details and collection and payment details (if payment processing is in use).

Item Details

Only applicable if invoices or credit notes have been entered through Detailed Data Entry or the Sales Invoicing module. This option allows the user to enquire on the item details such as item description, quantity, price per unit, totals and the General Ledger posting account.

Payment Detail

If a transaction has been fully or partly settled, i.e. has a status of PAID, P/PAID, ALLOC or P/ALL, details of the settlement can be enquired upon.

Query Management

Allows the user to add, view, amend and clear queries and disputes against individual transactions as covered in the Credit Control section.

General Ledger

The user can enquire on postings made to the General Ledger for a specific transaction. Any transactions that have items held can only link to GL from the items details enquiry screen. VAT postings will not be shown; a separate GL enquiry will need to be made.

Amendment

Allows the user to amend the order reference comments, due date, days grace (if Interest charging is in use) and print indicators fields of the selected transaction.

Dispute

Allows the user to raise or clear a transaction dispute using a dispute code and value, as permitted in the Transaction Amend/Dispute function of Credit Control.

Plan

Link direct to Payment by Instalments (PBI) to view, amend or insert a payment plan.

DD Deallocation

If deallocation of a direct debit transaction is required, then, if this option is selected against the transaction requiring deallocation, the system will look at the payment details and automatically deallocate.

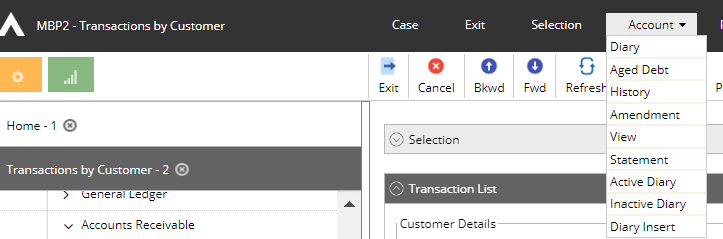

5. Customer related actions

Customer related actions are also available from the Account pull down menu.

Diary

Allows the user to view and amend existing diary events or create new ones.

Aged Debt

The user is shown a detailed breakdown of the debt analysis for that customer.

Historic Transactions

After transactions have been settled and have remained on the account for a user defined period of time, they can be archived (if the history database is in use), which moves the transactions into history. These transactions can still be viewed on-line.

Customer Maintenance (view)

Allows the user to go directly to the customer database. Two options are available to either view or amend customer details, subject to the user’s security settings.

Statement

This will set off a process to run a statement for the customer account.

6. Aged Debt

The Aged Debt Analysis facility provides the user with a detailed breakdown of the customer’s debt position.

Select the Aged Debt button.

Features

Customer aged debt will display the following information:

· 1 - 6+ Periods Overdue with a total overdue.

· Due This Period.

· Total Future Due.

· Unallocated Cash Aged/Unaged

· Disputed Total Aged/Unaged

· Total Debt

· Queries (Combined Memo & Dispute) YTD and Outstanding

· 4 period breakdown of the Total Future Due.

· Last Payment Details.

· Dunning Letter Details.

· Last Transaction entered onto the account.

· Year To Date Details (Highest Balance, Average Days To Pay, Average Days Late).

· 12 period breakdowns of the Year To Date Details.

· Memo Queries raised by 12 period breakdowns.

· Dispute Queries raised by 12 period breakdowns.

· Customer Details

· Debt Trends by period